How to Manage your finances Using the CEE framework

Last Updated on February 5, 2023 by Abolade Akinfenwa

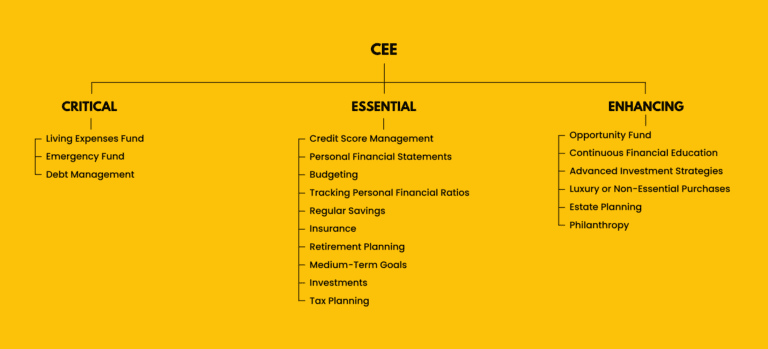

The “CEE framework” is a versatile prioritization framework. It provides a structured approach for prioritizing and managing financial decisions, breaking them into Critical, Essential, and Enhancing categories.

The CEE framework equips your financial journey with clarity, direction, and purpose. It offers a clear roadmap, preventing random financial decisions that may mar your financial progress.

Adopting this structure lets you know where to focus your efforts, ensuring stability before building toward growth and optimizing your financial well-being.

In this guide, we will examine the CEE framework and how you can use it to prioritize and manage your finances.

Let’s dive in!

Table of Content

What is the CEE Framework?

The CEE frame is a comprehensive and flexible framework, able to cater to different situations and objectives.

However, it didn’t just appear out of thin air. It originated from the U.S. military—commanding officers often adopted it as a decision-making framework [1].

The idea was to use the framework to prioritize combat-related decisions by grouping them into three categories: Critical, Essential, and Enhancing.

As time passed, people found value in this effective prioritization structure, refining and adapting it to their daily lives. And now, we have decided to adapt it to personal finance as a means of prioritizing and managing financial tasks.

Read on to find out how the preceding categories enable clear prioritization of financial tasks.

In a hurry and can’t read this guide in one go? Download a free e-copy to read whenever you have the chance!

Download Link: CEE: A Framework for Prioritizing and Managing Your Finances

Critical (C)

The Critical category covers financial elements necessary for your financial survival and stability.

Failing to take care of these non-negotiable financial elements can jeopardize your financial stability, potentially leading to significant hardships or even financial ruin.

Therefore, you must prioritize them to ensure a stable financial foundation upon which you can build and grow your finances.

Let’s have a look at the top three financial elements that typically make up the Critical category:

1. Living Expenses Fund

Shelter, food, utilities, and transportation are the bedrock of daily life.

Allocating a portion of your income to these essentials ensures you and your family have a stable living environment.

As a rule of thumb, you should always have at least six months’ worth of your living expenses in an accessible account.

2. Emergency Fund

Life is unpredictable.

Car problems, major home repairs, minor medical crises, and unexpected job losses have a way of happening when least expected.

That’s why an emergency fund is essential—it acts as your financial buffer against these unexpected events.

While the traditional advice is to save three to six months of living expenses [2], consider adopting a more personalized approach:

- Identify the top five uninsurable contingencies you’re most likely to face.

- Estimate the realistic cost to address each of these emergencies.

- Multiply the total estimated cost by three to determine your target emergency fund.

Before finalizing your emergency fund target, compare the resulting figure to the amount representing six months of your living expenses. Choose the higher number to ensure ample coverage.

Your aim should be to have an emergency fund that adequately covers significant unexpected expenses. Achieving this will help you avoid debt and protect your other financial goals from being compromised when life throws you a curveball.

3. Debt Management

Tackling these debts head-on stops the costly cycle of interest accumulation and late fees, freeing up more of your income for other financial goals.

Additionally, effectively reducing your debt over time improves your credit score, opening doors to more favorable borrowing terms in the future, such as when applying for a mortgage.

Consequences of Neglecting Critical Financial Obligations

In the CEE framework, the Critical category is the cornerstone of your financial stability.

It’s essential to prioritize tasks in this category to establish a solid financial base upon which you can build and grow your finances.

Neglecting Critical financial tasks can undermine your financial stability in the following ways:

1. Immediate Financial Instability

Critical financial tasks are foundational for maintaining day-to-day financial stability. Neglecting them can lead to swift and severe difficulties.

For example, without an emergency fund, losing your job due to an economic downturn might leave you unable to afford basic needs like food or transportation, pushing you to depend on high-interest debt.

2. Debt Accumulation

As demonstrated by the preceding example, neglecting critical financial tasks often leads to accumulating debt, particularly when one is forced to borrow for necessities or unexpected emergencies.

For instance, lacking a living expenses fund means a delayed paycheck could push you towards high-interest options like payday loans to manage daily expenses such as groceries, utilities, or commuting. This scenario can quickly spiral into a cycle of escalating debt.

3. Penalties and Additional Costs

Overlooking financial obligations like debt repayments or essential bills can lead to late fees, increased interest rates, or other penalties.

Missing several credit card payments, for example, can result in late payment fees and a higher APR, making it even harder to pay down the balance.

4. Risk of Legal Consequences

Some critical financial tasks, if ignored, could have legal repercussions, such as eviction due to unpaid rent or potential lawsuits from unpaid debts.

For example, consistently failing to pay your rent can force your landlord to legally evict you, leaving you without a place to live.

5. Long-Term Financial Repercussions

While the impact of neglecting critical tasks is often felt immediately, it can also have long-lasting effects, like severely damaged credit scores, which can take years to recover.

Defaulting on a loan, for instance, often leads to immediate repercussions from the lender and can also drastically lower your credit score, affecting future borrowing opportunities for years.

Essential (E)

The Essential category focuses on financial to-dos that, while not pressing, are pivotal for setting yourself up for a secure and prosperous financial future.

When ignored, these financial tasks might not cause immediate harm but can lead to missed growth opportunities or challenges.

Let’s briefly review the top ten financial tasks that fall under the Essential category:

1. Credit Score Management

Your credit score is a numerical representation of your creditworthiness.

It affects the interest rates received on loans and credit cards.

Therefore, it’s vital to regularly monitor your score and take proactive measures to improve or maintain it.

A high credit score gives you access to better financial terms, saving you considerable money over time.

2. Personal Financial Statements

Maintaining up-to-date personal financial statements is crucial for financial success. That’s because each statement provides data that aid in analyzing and improving your financial health.

There are two main types of personal financial statements: balance sheet and cash flow statement.

Your balance sheet is an overview of your financial position at any specific time. It is a list of your assets (what you own) and liabilities (what you owe).

When you subtract your liabilities from your assets, you get your net worth, a crucial indicator of your financial capacity and stability.

The cash flow statement, on the other hand, records your income and expenses over a certain period, usually a month.

It provides a clear picture of where your money is coming from and going, allowing you to identify financial patterns that help you allocate your money effectively.

Consistently reviewing these documents reveals actionable insights into your financial well-being. They help monitor your progress, identify potential issues, and adjust your strategy to align with your financial objectives.

Ultimately, these documents ensure you stay on course for a stable and secure financial future.

3. Budgeting

A budget is your roadmap for keeping your finances on track and preparing for the future.

It guides you on how to allocate your income to meet your needs, satisfy your wants, save and invest for the future, and repay debt.

Without a budget, you’ll be flying blind with your money. With it, you’ll be in control, ensuring your spending aligns with your financial goals, and you’re moving in the right direction.

Check the “recommended reading” section at the end of this guide to learn how to create the famous 50-30-20 budget using our free personalizable spreadsheet template.

4. Tracking Personal Financial Ratios

Tracking personal financial ratios is a crucial goal, as they represent vital indicators of your financial health

Ratios, such as the financial independence and debt-to-asset ratios, measure your financial standing in clear, quantifiable terms.

Regularly monitoring these ratios gives you access to real-time data designed to guide your financial decisions and keep you on course toward your long-term objectives.

For a deeper dive into which ratios to track and their implications, refer to the “recommended reading” section at the end of this guide for a detailed analysis of the top 22 financial ratios crucial for maintaining a healthy financial outlook.

5. Regular Savings

Savings are important because they provide the means to achieve your long-term financial goals, like buying a home or retiring comfortably.

By setting aside a consistent portion of your income, you’re not only building a financial cushion but also cultivating a habit that ensures you’re prepared for future needs, both anticipated and unexpected.

Moreover, regular savings can also serve as a backup should your emergency fund be depleted, reducing your need to incur debt during difficult periods.

6. Insurance

Think of insurance as a shield against unforeseen, costly emergencies that can derail your finances. It offers a way to protect yourself from significant expenses while preserving your savings and ensuring they remain intact for their intended purpose.

Instead of depleting your emergency or personal savings to cover large, sudden costs, insurance can absorb most or all of these expenses, protecting your financial stability. For instance:

- Health insurance can prevent a medical emergency from becoming a financial catastrophe.

- Auto insurance covers damages to your vehicle and protects you from potential personal liabilities.

- Home or renters’ insurance safeguards your possessions and offers liability protection.

By maintaining appropriate insurance coverage, you guard yourself against potential financial setbacks.

7. Retirement Planning

Starting your retirement planning early allows more time for your investments to grow, leveraging the power of compound interest.

Even if retirement seems decades away, remember that the earlier you begin, the more you benefit from compound growth, significantly boosting your financial security in your golden years.

No matter your current age or distance from retirement, with a steady income, it’s wise to begin contributing now. Doing so lets you lay a solid foundation for a comfortable and secure retirement.

Leverage retirement savings accounts like 401(k)s and IRAs to capitalize on tax advantages, amplifying your savings potential over the years.

8. Medium-Term Goals

Balancing long-term objectives with medium-term goals is essential to building a solid financial foundation.

Whether buying a home in five years or financing your child’s education in ten, planning and saving now sets you up for success.

By identifying and saving for these goals now, you’re less likely to rely on debt, ensuring a smoother financial path ahead.

9. Investments

Investing is necessary to build a solid financial foundation. It allows your money to grow and potentially outpace inflation, exponentially increasing your wealth.

However, it’s important to remember that all investments carry risks, including possibly losing your capital

But there’s a strategy to manage this risk: diversification.

By spreading your investments across different uncorrelated asset classes, you can balance the potential for higher returns with your risk tolerance.

If you prefer low-risk investments, options like certificates of deposit or treasury securities suit you. However, be prepared for low returns relative to the subsequent risk levels.

For a moderate risk level, consider index funds, real estate investment trusts (REITs), or dividend-paying stocks.

And if you’re open to high risk for potentially higher returns, you might explore individual stocks, cryptocurrencies, or investing in startups.

Think of investing as a core part of your strategy for long-term financial security and achieving your future lifestyle.

Adapt your investment choices to your goals, risk tolerance, and timeline.

And if you need some help, don’t hesitate to consult a financial advisor to customize an investment plan that fits your unique needs and circumstances.

10. Tax Planning

The financially savvy know that taxes should not be paid without forethought.

By strategizing in advance, you can ensure you’re only paying what is necessary in taxes. This involves leveraging available deductions and credits to your advantage.

Regularly reviewing and planning your taxes can lead to considerable savings, a key element of effective financial management.

Make it a habit to stay informed about tax law changes, explore tax-saving investment options, and consider consulting with a tax professional to optimize your tax strategy.

This proactive approach not only reduces your tax liability but also enhances your overall financial health.

Consequences of Ignoring Essential Financial Tasks

In the CEE framework, the Essential category includes tasks that are key to your financial health over the long term.

Though these tasks may not require immediate attention, they are fundamental to building and maintaining long-term financial security and growth.

Ignoring Essential tasks doesn’t have immediate repercussions like Critical tasks, but over time, neglecting them can lead to substantial issues, including the following:

1. Missed Growth Opportunities

Overlooking essential financial tasks, especially saving and investing for retirement, means missing out on the power of compound growth and limiting your wealth’s potential.

For instance, if you put off starting contributions to a 401(k) or IRA for a decade, you could lose a substantial amount in compound interest, potentially costing you tens to hundreds of thousands of dollars by the time you retire.

2. Inadequate Preparation for Life Events

Not saving for medium-term goals can leave you unprepared for consequential life events like buying a home, funding your child’s education, or even taking that desired trip.

For example, if you don’t save for a down payment, you may be unable to purchase a home when ready, leading to less favorable loan conditions or settling for a less preferred location.

Prioritizing setting aside funds for these milestones ensures you’re ready when the time comes.

3. Potential Tax Complications

Without proper tax planning, you risk overpaying or missing out on deductions and credits, resulting in unnecessary financial losses.

For example, neglecting to track tax-deductible expenses throughout the year could lead to paying thousands more in taxes than required.

Staying vigilant about potential tax savings helps optimize your financial efficiency.

4. Credit Challenges

Neglecting managing your credit score could make it drop, making it harder for you to get loans or credit with good terms. This can lead to higher interest rates on major loans like mortgages or auto loans, potentially costing you thousands more over the loan’s lifetime. Pay attention to your credit score to avoid these costly consequences.

5. Reduced Financial Security in Later Years

Ignoring retirement planning can lead to inadequate savings for a comfortable retirement, forcing you to depend mainly on limited social security benefits or work beyond the usual retirement age.

For example, without enough savings, you may have to take up part-time jobs during your golden years to cover everyday expenses.

Enhancing (E)

The Enhancing category of the CEE framework represents the “financial extras.” While not essential to your financial stability, these tasks can further elevate your financial situation. They provide growth opportunities, added comfort, and even positive societal contributions.

Now, let’s take a look at the top six financial elements commonly found in this category:

1. Opportunity Fund

An opportunity fund is a stash of cash set aside for seizing time-sensitive financial opportunities as they arise.

This fund fits under the Enhancing category because it’s not about covering your necessities (Critical) or securing your future (Essential); it’s about having the flexibility and agility to capitalize on potential growth opportunities that occasionally surface.

An opportunity fund isn’t meant for everyday expenses or routine investments. Instead, it’s for those unique opportunities that come by unexpectedly and shouldn’t be missed due to a lack of funds.

Think of it as your financial “strike fund.” When a solid investment or a promising startup opportunity comes your way, this fund allows you to act swiftly and take advantage without disturbing your financial plan.

2. Continuous Financial Education

Maintaining up-to-date knowledge is crucial in a world of constantly changing financial dynamics.

Whether through the latest books, relevant courses, or informative seminars, keeping abreast of financial developments is pivotal to managing your money effectively.

This commitment to continuous financial education goes beyond accumulating knowledge; it’s about empowering yourself to make intelligent decisions, spot emerging investment opportunities, and devise effective strategies for protecting and growing your wealth.

Staying committed to continuous financial education is critical to your economic well-being. It ensures you’re adaptable and well-informed, enabling you to navigate the complexities of the financial world with confidence and agility.

3. Advanced Investment Strategies

Beyond traditional stocks and bonds, there are other investment opportunities.

Real estate, for instance, can offer the dual benefits of rental income and potential capital appreciation

Alternatively, commodities, cryptocurrencies, and precious metals can diversify your portfolio, potentially reducing risk and enhancing returns.

While these advanced investment strategies can help grow your wealth exponentially, they require careful research and understanding.

It’s often wise to seek advice from financial experts to navigate these markets successfully and align these investments with your overall financial goals and risk tolerance.

Remember, the more complex the investment, the more critical it is to be well-informed and cautious.

4. Luxury or Non-Essential Purchases

You likely have aspirations that extend beyond basic needs. Maybe you dream of owning a luxury car, enjoying premium products, or vacationing in exclusive destinations.

While not essential for financial growth, these purchases contribute to your life’s fulfillment and enhance your life’s quality.

It’s crucial, however, to balance these desires with your overall financial plan, ensuring they don’t compromise your long-term financial stability.

Indulging responsibly in these luxuries can bring joy and a sense of achievement, enhancing your overall well-being.

Remember, balancing these indulgences with your overall financial plan is important. Ensure they’re sustainable and don’t impede your essential financial goals.

5. Estate Planning

Though it may feel uncomfortable, planning for the distribution of your assets after you’re gone is a necessary and responsible action.

Doing so ensures that your wealth is allocated according to your wishes. Besides, it offers tax benefits as well.

Using tools like wills and trusts allows you to manage how your assets are distributed, minimizing family disputes and safeguarding your heirs from hefty tax liabilities.

Overall, proper estate planning not only provides you with peace of mind but also ensures your legacy is handled as you intend, offering clarity and support to your loved ones during a difficult time.

6. Philanthropy

As your financial situation improves, you may find yourself wanting to contribute to the greater good.

Engaging in philanthropy through charitable donations not only provides societal benefits but can also offer tax deductions.

If you possess substantial assets, establishing a charitable foundation can be an effective way to make enduring positive changes. Such foundations can also provide tax advantages, making them a financially savvy way to give back.

This approach allows you to align your financial success with your values, creating a legacy that extends beyond personal wealth.

Consequences of Overlooking Enhancing Financial Opportunities

Under the CEE framework, Enhancing financial elements is about amplifying your financial journey.

Engaging in philanthropy through charitable donations not only provides societal benefits but can also offer tax deductions.

Engaging in these tasks means you’re not just securing but actively enriching your financial and personal life.

If you overlook financial tasks in the Enhancing category, you might have to endure the following:

1. Missed Wealth Maximization

While skipping Enhancing tasks won’t destabilize your financial situation, you risk missing opportunities to increase your wealth significantly.

For instance, without an opportunity fund, you might be unable to take advantage of timely investment prospects or unique deals that could yield considerable returns.

2. Problematic Wealth Transfer

Failing to engage in thorough estate planning means your assets may not be allocated according to your desires after you pass away. This oversight can lead to avoidable taxes and potential legal disputes among your heirs.

For example, without a clear will or trust, your family might face a lengthy court battle over your estate, which could strain relationships and reduce their inheritance due to legal costs.

3. Limited Financial Knowledge

If you don’t continuously educate yourself financially, you risk missing out on emerging strategies, investment opportunities, or important changes in the financial world that could be advantageous to you.

Staying informed is key to making the most of your financial potential.

4. Potential Lifestyle Regrets

While not crucial for financial stability, Enhancing tasks connect closely to your desires and dreams.

Ignoring these can result in regrets about missed opportunities or not fully embracing life.

For example, continually putting off hobbies, interests, or luxury experiences you can afford might lead to feelings of regret for not seizing life’s opportunities when you had the chance.

Remember, it’s about finding a balance that allows you to enjoy the fruits of your labor while maintaining financial health.

5. Reduced Societal Impact

If giving back is important to you, failing to allocate funds for philanthropy means losing the chance to positively influence the community or support causes close to your heart.

Your contributions can make a meaningful difference, aligning your financial success with your values and societal goals.

Benefits of Using the CEE Framework

As you might have deduced, adopting the CEE framework unlocks several benefits for those who use it. Here are the top three benefits we’d like to highlight:

1. Clear Financial Direction

Using the CEE framework, you can pinpoint your key financial priorities and establish specific goals.

You may determine, for instance, that tackling high-interest debt is a critical task, saving for retirement is an essential objective, and saving for a luxury vacation falls under an enhancing goal.

This framework brings clarity, enabling you to direct your financial efforts effectively towards where they matter most.

2. Simplification of Complex Financial Decisions

The CEE framework makes financial decisions more manageable. It simplifies the distribution of your funds, making complex financial decisions more manageable.

Take, for instance, deciding how to spend a bonus. With this framework, you’d prioritize clearing any Critical debts first, then contribute to Essential needs like your retirement fund, and finally, if there’s a surplus, allocate funds to an Enhancing goal such as upgrading your car.

3. Flexibility to Adapt to Changing Financial Status Quo

As your life and financial situations change, the CEE framework adapts with you.

For instance, as retirement approaches, your financial priorities naturally shift. A goal once categorized as Enhancing, such as saving for leisure activities in retirement, transitions to being an Essential one, focusing on securing a comfortable lifestyle after you stop working.

This framework’s flexibility allows you to realign your financial strategies to fit your evolving needs and goals.

How to Apply the CEE Framework to Your Finances

Now that you know what the CEE framework is all about and the various typical financial elements that fall under each category, let’s dive into how you can apply the framework to your finances in four simple steps.

Step 1: Assessment—Understand Your Current Financial Status and Goals.

Before applying the CEE framework to your finances, you must get a clear snapshot of your financial standing. Here’s how you do that:

1. Review Your Personal Financial Statements

Start by pulling up your balance sheet and cash flow statement. These documents are like a financial mirror—they reflect your financial health.

When reviewing them, focus primarily on two crucial metrics: your net worth and net cash flow.

- Assess Your Net Worth: Have a positive net worth? That’s a good sign; it means your assets outweigh your liabilities. However, if your net worth is negative, it’s an urgent signal that your debts need immediate attention. Think of it as being financially underwater; your immediate goal should be to “swim” back to the surface by diligently paying off these debts pronto.

- Analyze Your Net Cash Flow: Look at your incoming versus outgoing cash. If your expenses exceed your income, it’s a signal to cut back on spending or increase your earnings. The goal is to manage your outflows so they don’t surpass your inflows, ensuring a positive net cash flow.

2. Examine Your Budget

Next, evaluate your budget to see how your spending measures up against your planned allocations.

If your expenses consistently exceed your planned allocations, it’s a clear sign that your spending habits need reassessment.

Go through each category in your budget, identify areas where you can reduce non-essential spending, or find ways to increase your income.

This exercise is crucial to ensure your financial plan remains on track.

3. Evaluate Your Personal Financial Ratios

Just like a doctor uses vital signs to assess people’s health, you can use financial ratios to diagnose your finances’ health.

They’ll pinpoint areas that need preventive action or even emergency intervention.

Too much debt? Poor savings rate? Inadequate emergency fund? Low Investments? These ratios will tell you.

Check the recommended reading section at the end of this article to learn how to calculate and interpret 22 personal financial ratios.

4. Set Clear Financial Goals

This is your financial soul-searching time.

This is where you combine all the insights gleaned from reviewing your personal financial statements, budget, and ratios to develop goals that help improve your weak points.

These goals are what you then categorize and prioritize using the CEE framework.

Note: Remember, this initial assessment is the cornerstone of creating your financial plan using the CEE framework. It’s not about judgment—it’s about clarity and setting the stage for informed, strategic decisions that align with your financial reality and life’s aspirations.

Step 2: Prioritization—Use the CEE Framework to Rank Financial Goals

Once your financial goals are outlined, it’s time to categorize and prioritize them using the CEE framework.

As you begin to do this, however, you’ll quickly realize that what fits into each category isn’t set in stone. It’s subjective, shaped by your unique financial situation, your goals, and what you value most.

Think of the Critical category, for instance. For most, this includes basic needs—shelter, food, and electricity. But what’s critical for you might extend to monthly prescriptions, car payments, or internet connection—if your livelihood depends on it.

Moving on to Essentials, these are important but not life-or-death financial goals. Retirement savings and insurance typically land here.

But what if you’re nearing retirement age or have a chronic condition? Then, increasing your retirement contributions or securing top-notch health insurance may become critical for you.

Then there are the Enhancing financial goals. These are generally your wants rather than needs—like that annual vacation or the latest smartphone. For you, these are nice-to-haves, not must-haves.

But let’s say you’re a business owner, and having the latest tech helps you generate more sales. Suddenly, that new gadget isn’t just Enhancing; it’s essential for your business.

The key takeaway? Your financial priorities are unique to you. They’re based on your current needs, future goals, and the realities of your life.

What’s more, they’re not set in stone. As your life changes—say you start a family or get a promotion—what financial goal falls into each CEE category can change.

In other words, what’s Essential today could be Critical tomorrow, and what’s Enhancing now might become Essential.

For example, a regular subscription to a professional networking site, initially considered to enhance career development, may become critical as it becomes an essential tool for job hunting and networking to secure a new employment opportunity.

One more thing.

Financial goals are often perceived differently based on an individual’s circumstances, stage of life, and personal values. Therefore, what’s Essential for some can be Enhancing for others, and vice versa.

For instance, an individual nearing retirement age might consider maximizing their retirement savings a Critical goal to ensure they can retire on time and maintain their lifestyle.

Conversely, a younger person in the early stage of their career may prioritize retirement savings as Essential because, with a longer time horizon, it’s not a Critical goal.

Similarly, for individuals with high-interest debt, such as credit card debt, aggressive repayment may be a Critical goal to avoid spiraling interest costs.

However, for those with low-interest debt, like student loans, debt repayment may be prioritized as an Essential goal that is part of their long-term financial plan but not Critical to address immediately.

In essence, when prioritizing your financial goals using the CEE framework, remember it’s all about what’s true for you now.

Step 3: Implementation—Take Action Based on the CEE Categorization

Without action, a plan remains just that.

Once you’ve outlined your financial goals and prioritized them using the CEE framework, roll up your sleeves—it’s time to act.

Here’s how you can put your plan into motion, step by step:

1. Tackle the Critical Financial Goals First

Living Expenses

Open a separate account specifically for your living expenses fund. Automate a portion of your income to go directly into this fund every time you get paid.

Ideally, this fund should always cover at least three months’ worth of your rent or mortgage, utilities, groceries, and any other recurring monthly expenses.

Emergency Fund

If you haven’t already, set up an emergency fund account. Then, arrange automatic transfers from your checking to this savings account, timed with your paychecks.

Doing this ensures you’re consistently building a safety net. Don’t worry if you can only afford a small percentage of your income—something is better than nothing.

Debt Repayment

Have high-interest debts? Deal with them first.

If you’re juggling balances on several credit cards, automate payments for more than the minimum due, starting with the highest-rate card.

Consider transferring balances to a lower-rate card if possible. You can also use the debt snowball or avalanche strategies, focusing on one debt at a time for more efficient repayment.

2. Next, Address Essential Financial Goals

Credit Score Management

Get your credit report from the major bureaus at AnnualCreditReport.com—it’s free once a year for all credit reporting companies and free once a week from Equifax, Experian, and TransUnion.

Check for errors and dispute them if necessary.

To manage your score, pay your bills on time, every time. Setting up reminders or automatic payments helps you never miss a due date.

Also, consider keeping your credit utilization—how much credit you’re using compared to how much you have—below 30%.

If you have high credit card balances, create a payment plan to pay them off quickly.

Finally, don’t close old accounts, as they contribute to your credit history length, which can help boost your credit score.

Budgeting

If you don’t have one yet, draft a budget that covers the three essential categories of your expenses: Needs, Wants, and SIDR (Savings, Investments, and Debt Repayment).

Use a budgeting app or spreadsheet to allocate funds for each category. Be realistic about what you spend and cut back where you can.

The goal is to ensure your total expenses don’t exceed your income.

Feel free to download our free budgeting template to create a personalized budget.

Tracking Personal Financial Ratios

Interested in tracking your personal financial ratios but need help knowing where to start? Check the recommended reading section at the end of this article to learn how to calculate and interpret key personal financial ratios.

Personal Financial Statements

Interested in monitoring your assets and liabilities and cash inflows and outflows but don’t know where to start? Check the recommended reading section at the end of this guide to learn how to build a balance sheet and cash flow statement.

Regular Savings

Start by determining how much of your monthly income you can save. Decide on a realistic percentage to save—perhaps 10% to 15% of your income. Then, automate it.

Set up a direct transfer from your checking account to a savings account on payday. This way, you save without even thinking about it.

Please ensure this savings account is separate from your everyday account to reduce the temptation to dip into it.

Insurance

Review your insurance policies annually. Adjust coverage to fit changes in life circumstances.

Shop around for better rates and bundle policies where possible. Use higher deductibles to lower premiums if you have savings to cover them.

Always ensure the essentials—health, auto, home, and life—are adequately protected.

Retirement Planning

If you’re employed, maximize your employer’s retirement plan contributions—it’s free money. If not, open an IRA or a Roth IRA and set up automatic monthly contributions.

Medium-Term Goals

Identify your medium-term goals—anything from 1 to 5 years out. This could be buying a new car, renovating your home, or a significant family vacation.

Figure out the cost and work backward to understand how much you need to save each month.

Open a dedicated savings account and create individual savings plans on a single account, or set up an investment account for each goal.

As with your regular savings, set up automatic transfers on each payday for each goal.

Investments

If you’re new to investing, start with something straightforward, like low-cost index funds or ETFs.

The key is to start small, learn as you go, and consistently contribute to your portfolio.

If you’re already investing, review your portfolio. Is it diversified? Does it match your risk tolerance? If not, make adjustments.

Tax Planning

Don’t wait until April to think about taxes. Throughout the year, keep track of expenses that could qualify for deductions, like charitable donations or business expenses if you’re self-employed.

Ensure you’re using all the deductions and credits you’re entitled to. Consider contributing to retirement accounts that offer tax advantages, like a traditional IRA or a 401(k), to reduce your taxable income.

Also, consider consulting with a tax advisor to plan for any major financial moves that could have tax implications, like selling property or withdrawing from retirement accounts early.

3. Then Enhance with Purpose

Opportunity Fund

For your Opportunity Fund, start by setting aside a portion of your disposable income—this is the cash you have left after covering your Critical and Essential expenses.

Decide on an amount or percentage of your income that you’re comfortable with, and regularly transfer it to a dedicated savings or investment account.

This shouldn’t be money you’ll need for daily living or emergencies. Rather, it should be a calculated slice of your income earmarked for when a not-to-be-missed opportunity comes knocking.

Remember, this fund is for growth opportunities that can enhance your financial portfolio, not for splurges or impulse buys.

Continuous Financial Education

Set aside a specific time each week to learn about finance. Read books, subscribe to financial newsletters, or take online courses. Attend workshops or seminars when possible to keep your knowledge up-to-date.

Advanced Investment Strategies

Educate yourself on different investment vehicles or consult with a financial advisor. Start small with more complex investments like individual stocks, real estate, commodities, or cryptocurrencies to understand the risks and rewards.

Luxury or Non-Essential Purchases

Save for luxuries separately from your essential savings. Wait for the right time to purchase—ideally, when it won’t impact your critical financial goals. Treat these buys as rewards for achieving milestones.

Estate Planning

Consult with an estate planner or attorney to draft a will, set up trusts, or plan your estate.

Regularly review and update these documents, especially after significant life events.

Doing so will ensure your assets are distributed according to your wishes and potentially minimize taxes and legal complications for your heirs.

Philanthropy

Decide on causes important to you and how you want to support them—through volunteering time or donating money.

Set up a budget for charitable contributions, or consider establishing a donor-advised fund if you’re thinking of larger or long-term philanthropic commitments.

Step 4: Review and Adjust—Continually Evaluate and Refine Your Financial Plan

Your financial journey is dynamic, constantly evolving as your life does. That’s why your financial plan can’t just be set and forgotten. It needs regular upkeep, just like a car needs servicing.

Here’s how you can keep your financial engine running smoothly:

1. Set Regular Review Dates

Set specific times throughout the year for a comprehensive financial plan review. Don’t let these reviews slide—treat them with the same seriousness as a work meeting or a doctor’s appointment.

Use each check-in to assess progress towards your financial goals and ensure your prioritizations still match your current circumstances. The key is to be proactive, not reactive.

2. Identify Changes in Your Life

Have you had any major life events recently? A new job, marriage, or a new baby? Maybe you’ve paid off a significant debt, or your income has changed. Each of these can impact your financial priorities and strategies.

Got a raise? Great, decide how to allocate the extra income—maybe increase savings or pay down debt faster. Increased expenses? Figure out where to cut back or adjust your budget to accommodate these changes.

3. Revisit Your Goals

Your financial goals may shift as you move through life. Regularly reassess your goals to ensure they still align with your current life situation and future aspirations. The goal is to ensure your financial goals reflect where you are now.

Also, consider how you prioritized your financial goals. Do they reflect your current and future anticipated needs? What seemed important five years ago might not hold the same weight today, and what was an afterthought a few months ago might now be a pressing need.

For example, say you’ve been saving for three years to buy a sports car. However, with a family, you may decide having a safe and spacious vehicle is now a priority.

4. Monitor Your Financial Performance

Keep a close eye on your investments. Are they performing as expected? Do they still fit your risk tolerance? And don’t just focus on investments—review your savings levels, debt status, and how well you’re adhering to your budget. Ideally, savings should increase, debt should decrease, and expenses shouldn’t exceed your budget.

5. Adapt to Economic Changes

The economy is constantly in flux, and these changes can directly affect your finances. Interest rate hikes, inflation, or market downturns can necessitate tweaks in your financial plan.

For instance, suppose interest rates go up; your payments could increase if you have a variable-rate mortgage or loan. In this case, you may need to adjust your budget to accommodate the extra expense or consider refinancing to a fixed-rate option if possible.

6. Evaluate Insurance Needs

Your insurance needs today might not be what they were a year ago. Periodically review your coverage to ensure it’s still adequate, especially after major life events like getting married, having a child, or buying a home.

7. Stay Informed

Keep an ear to the ground for financial news and trends. What happens in the broader economy can impact your finances. Being informed helps you anticipate and prepare for these effects.

For example, say the government announced a new policy offering tax incentives for renewable energy investments. You may capitalize on the opportunity by adjusting your investment portfolio to include green energy stocks. Doing so allows you to benefit from both fiscal advantages and market growth.

8. Implement Changes

After each review, take action where needed. This could involve tweaking your savings strategy, revising your budget, or rebalancing your investment portfolio.

9. Consult with Professionals

If you need clarification on certain aspects of your financial plan or if there’s a significant change in your life or the economy, reach out to a financial advisor. They can provide expert advice and help steer you in the right direction.

Remember: The purpose of these reviews is to ensure your financial plan is still working effectively for you. It’s about staying on track, adapting to change, and making sure you’re always moving toward your financial goals.

By regularly reviewing and adjusting your financial plan, you ensure it stays aligned with your evolving life and goals. This continuous process keeps your financial plan relevant and effective, guiding you toward your long-term aspirations.

Pro Tips on Prioritizing and Managing Your Finances

Now that you know how to apply the CEE framework to your finances, it’s time to learn some handy tips to help you prioritize and manage your finances effectively.

1. Don't Neglect Critical Financial Elements Until It's Too Late

Always address your Critical financial elements first. Ignoring these elements might make your finances unstable when unexpected expenses hit.

For instance, not having an emergency fund can force you into high-interest debt if you suddenly find yourself in between jobs.

So, ensure you tackle critical financial tasks early to avoid such pitfalls.

2. Don't Overemphasize Enhancing Financial Elements at the Expense of Essential Tasks

According to the rule:

For example, before taking a luxury vacation, ensure you’ve set up a retirement savings account and regularly contribute to it.

3. Revisit and Adjust Your Financial Plan as Situations Change

Life changes, and so should your financial plan. Regularly review and adjust your financial plan to align with your current situation and goals.

For instance, say you receive a significant salary increase. This increase should prompt a review of your financial plan, perhaps to boost retirement savings, pay down debt faster, or increase your house down payment fund.

Regularly adjusting your plan ensures it aligns with your current situation and evolving goals.

4. Financial Prioritization is Subjective

Remember, financial priorities vary from person to person. What’s Critical for you may be Essential or even Enhancing for someone else.

For instance, life insurance might be a Critical goal if you have a family to support. In contrast, it could be an Essential goal for a single person with no dependents.

Tailor your CEE financial plan to your personal circumstances and goals to ensure that the plan is highly relevant and effective for your unique situation.

5. Seek Expert Advice When Needed

Sometimes, financial situations get complex, and DIY approaches don’t cut it. If you’re facing complex financial decisions or navigating unfamiliar territory, don’t hesitate to consult a financial advisor. They can help you avoid common missteps and capitalize on opportunities you might not be aware of.

Case Study: A Marketing Manager's Journey with the CEE Framework

In a world where financial advice often feels one-size-fits-all, let’s review the story of Emily, a middle-aged marketing manager in Boston who earns $80,000 annually.

Emily faces a predicament familiar to many: earning a decent income but lacking a clear financial roadmap.

Her financial obligations include $20,497 in student loans and $9,826 in credit card debt. On the flip side, she has $50,014 in her 401k account, and her savings account contains a modest $1,967, earmarked for no specific goal.

In this brief case study, we’ll provide a relatable perspective on applying the CEE framework to your finances using the five steps shared earlier in the guide.

Step 1: Assessment

Emily thoroughly examines her finances. As she dives into her bank statements, she uncovers some uncomfortable truths:

- A larger-than-expected slice of her income went towards non-essential spending. Nights out with friends, impulsive online shopping sprees, and a collection of rarely used subscription services guzzled 39%, 45%, and 36% of her annual income over the past three years. This revelation was startling.

- The credit card balance, currently at $9,826, is not static; it’s ballooning due to accumulating interest. This is a clear red flag, signaling the urgent need for a structured repayment plan.

- Her savings are not earmarked for specific goals. The lack of a targeted saving strategy makes her efforts somewhat ineffective, especially since the contributions are erratic.

- She’s leaving free money on the table by failing to max out her annual 401(k) contributions. Besides, the $50,014 in her 401k account is less than her yearly income, indicating she has some catching up to do.

- The absence of an emergency fund underscores a significant vulnerability in her financial plan. Despite her decent income, she discovers she’s unprepared for unforeseen financial emergencies. Yes, she has some savings, but those funds are not allocated for specific emergencies and are more of an afterthought.

- The lack of a budget and personal financial statements made it difficult for her to gather the data necessary to evaluate her finances. She had to manually review her pay stubs and bank statements to track 401k contributions and expenses, which was time-consuming and stressful.

This assessment is Emily’s wake-up call; it laid bare the gaps in her financial management.

Armed with this newfound awareness, Emily recognizes the need for a change. She must adopt a structured financial plan to manage her income wisely.

Step 2: Prioritization

Armed with the insights from her financial assessment and understanding the necessity of a structured approach, Emily decided to adopt the CEE framework to prioritize her financial tasks.

Critical: Tackling Immediate Financial Threats

- Cut Non-Essential Spending: Emily critically evaluates her lifestyle choices. She decides to drastically reduce her nights out, online shopping, and underused subscription services. These cuts are crucial for freeing up funds for more pressing financial needs, like debt repayment and setting up an adequate emergency fund.

- Pay Off Credit Card Debt: With a $9,826 accruing interest balance, Emily prioritizes paying off this debt. She develops a repayment plan, aiming to clear this debt as quickly as possible to avoid further interest accumulation.

- Establish an Emergency Fund: Recognizing the vulnerability of having no safety net, Emily commits to building an emergency fund. She sets a goal to save at least three months’ worth of living expenses.

Essential: Building Long-Term Financial Security

- Develop SMART Saving Goals: Emily sets specific, measurable, achievable, relevant, and time-bound goals for her savings. This includes earmarking funds for a house down payment and other future financial goals.

- Max Out 401k Contributions: Realizing the lost opportunity in her retirement savings, Emily decides to max out her 401(k) contributions. Doing this allows her to take advantage of her employer’s match program, effectively increasing her retirement funds.

Enhancing: Laying the Groundwork for Financial Management

- Create a Budget: Emily decides to develop a comprehensive budget. This includes categorizing her expenses and setting limits for each category, ensuring she adheres to her new spending plan.

- Personal Financial Statements: She commits to creating personal financial statements. These include a detailed balance sheet and a cash flow statement, giving her a clearer picture of her financial status and helping track her progress over time.

This step in Emily’s financial journey is transformative. It’s a shift from passive money management to active, purposeful financial planning. With the CEE framework guiding her, she feels more in control and confident in her path to financial stability and independence.

Step 3: Implementation

Emily, now with a clear plan, dives into the implementation phase, taking decisive actions to turn her financial situation around:

Cutting Non-Essential Spending

She starts by slashing her non-essential spending. Those frequent nights out, impulsive online shopping, and seldom-used subscription services are the first to go. She cancels several subscriptions she rarely uses and limits her nights out with friends to once a month. These cuts are not easy, but Emily understands they are necessary to free up funds for more important financial goals.

Paying Off Credit Card Debt

Emily starts paying more than the minimum amount due each month. She even uses some of her newly freed-up funds from reduced non-essential spending to make extra payments. With this aggressive approach, Emily is set to clear this debt much faster than if she were only making minimum payments.

Developing SMART Saving Goals

Emily gets strategic with her savings. She sets clear, measurable goals, like saving $20,000 for a house down payment in four years. She calculates how much she needs to save each month and creates a separate savings account for this purpose. This targeted approach makes her savings efforts more effective and goal-oriented.

Maximizing 401k Contributions

Understanding the importance of her future financial security, Emily increases her 401k contributions to the maximum amount possible. By maximizing these contributions, she takes full advantage of her employer’s matching contribution, effectively doubling her retirement savings efforts.

Establishing an Emergency Fund

Emily opens a new savings account designated as her emergency fund. She commits to an automatic transfer of a fixed percentage of her income into this account every payday. Her goal is to build a fund that covers at least three months of living expenses, providing her a cushion for unforeseen financial emergencies.

Creating a Budget and Personal Financial Statements

Emily designs a comprehensive budget, categorizing her expenses and setting spending limits for each category. She regularly tracks her income and expenses, adjusting as needed to stay within her budget.

Additionally, she starts maintaining personal financial statements, including a balance sheet and a cash flow statement. These documents provide a clear view of her financial progress and help her make informed financial decisions.

In this phase of her financial journey, Emily takes proactive steps to turn her plans into reality. Through these actions, Emily is not just hoping for a better financial future but actively building it.

Step 4: Review and Adjustments

Having implemented her well-thought-out financial plan, Emily now enters a crucial phase: reviewing and adjusting her plan.

Regular Financial Check-Ins

Emily establishes a routine for reviewing her finances. Every quarter, she sits down to evaluate her progress. She looks at her spending patterns, debt repayment, emergency fund growth, retirement fund performance, and savings progress.

Adjusting the Budget

During her reviews, Emily noticed certain areas where she could still cut back on spending. She fine-tunes her budget, redirecting these additional savings towards her debt repayment and emergency fund. This ongoing adjustment ensures that her budget remains realistic and effective.

Debt Repayment Progress

Emily’s strategy to pay off her credit card debt is working well. She has reduced the balance by about one-fifth in just three months. Encouraged by this progress, she decides to allocate more towards her student loan, accelerating its repayment.

Emergency Fund Milestone

To her satisfaction, Emily’s emergency fund reaches her initial target of three months’ worth of expenses within the first quarter. She decides to continue building this fund, aiming for a six-month cushion, giving her greater peace of mind.

Facing and Overcoming Challenges

Emily encounters challenges, such as staying within her new entertainment budget and resisting impulsive purchases. She overcomes these by reminding herself of her long-term goals and finding more budget-friendly ways to enjoy her leisure time.

Realignment of Goals

As she progresses, Emily realizes the need to realign some of her goals. Considering the current real estate market, her initial target for her house down payment seems ambitious. She recalibrates her savings plan, extending the timeline to match her saving capacity more realistically.

Conclusion

Emily’s journey through the CEE framework, from assessment to continuous refinement, highlights the importance of structured financial planning. Her experience is a relatable and inspiring example for anyone looking to take control of their finances, emphasizing that it’s not just what you earn but how you manage it that truly counts.

The Bottom Line

The CEE framework is an instrumental tool for prioritizing and managing your finances. This structured approach clarifies your financial decisions, aligning your daily actions with your broader financial goals.

We encourage you to apply the CEE framework to your finances. Start by evaluating your current financial state and categorizing your financial goals and tasks according to the framework.

This approach will guide you in making more informed decisions, ensuring you address the most pressing financial needs first while also planning for your future.

Remember, personal finance is not just about managing money; it’s about managing your life choices and priorities.

If you have questions about implementing the CEE framework or have observed something interesting in your financial journey, feel free to ask questions or share your thoughts.

Your insights and inquiries are valuable, and they can help others who are navigating similar paths. Whether you need clarification on categorizing your financial goals or want to share a success story, your comments and requests can contribute to a richer understanding for everyone.

Remember, you’re not alone on this financial journey; together, we can learn and grow.

FAQS

Why Should I Have a Living Expenses Fund When I Already Have an Emergency Fund?

Your emergency fund is a financial airbag; it’s meant to cushion unforeseen blows—a job loss, a medical emergency, or a sudden major home repair.

On the other hand, your living expenses fund is the day-to-day fuel. It ensures that your regular financial commitments are met without having to dip into your emergency reserves. This way, when an actual emergency hits, you’re not deciding between keeping the lights on and covering that unexpected cost.

Both funds safeguard your financial stability but play different roles in your overall financial plan.

About the Author

Abolade Akinfenwa is a multi-certified finance professional. He’s certified as a Financial Modeling & Valuation Analyst (FMVA)®, Capital Markets & Securities Analyst (CMSA)®, Commercial Banking & Credit Analyst (CBCA)®, Financial Planning & Wealth Management Professional (FPWM)™, and FinTech Industry Professional (FTIP)™. With over three years of experience as a Financial Writer, Abolade specializes in helping finance professionals build authority and generate qualified leads for their services. Interested in collaborating or seeking insights? Connect with Abolade via LinkedIn or X, or email him.

Sources

At ACDS Publishing, we hold ourselves to the highest standard of accuracy and credibility, ensuring that our readers receive only the most verifiable and substantiated information. To achieve this, we rely on a rigorous approach that involves sourcing information from reliable primary sources, including white papers, government data, original reporting, and expert interviews. By employing these methods, we strive to deliver factual and authoritative content that our readers can confidently trust.

- Codie Sanchez. Accessed at https://x.com/Codie_Sanchez/status/1672598981468094468?s=20

- Investopedia. “Emergency Fund.” Accessed at https://www.investopedia.com/terms/e/emergency_fund.asp

- LendingTree. “Average Credit Card Interest Rate in America Today.” Accessed at https://www.lendingtree.com/credit-cards/average-credit-card-interest-rate-in-america/

- Payday Loan Information for Consumers. “How Payday Loans Work.” Accessed at https://paydayloaninfo.org/how-payday-loans-work

Get newsletter updates from Alex

No spam. Just the highest quality ideas that will teach you how to build wealth via the stock market.