Form DEF 14A: Definition, Importance, & Key Sections

As an investor or stakeholder, understanding the inner workings of a company is essential to making informed decisions. One of the ways to gather information about a company’s activities is by reviewing documents filed with the U.S. Securities and Exchange Commission (SEC).

One such document is Form DEF 14A, also known as the definitive proxy statement. This comprehensive guide will provide an overview of Form DEF 14A’s purpose, importance, key sections, and components. We will also examine how Form DEF 14A can be used to make investment decisions and consider some frequently asked questions.

Table of Content

What Is Form DEF 14A?

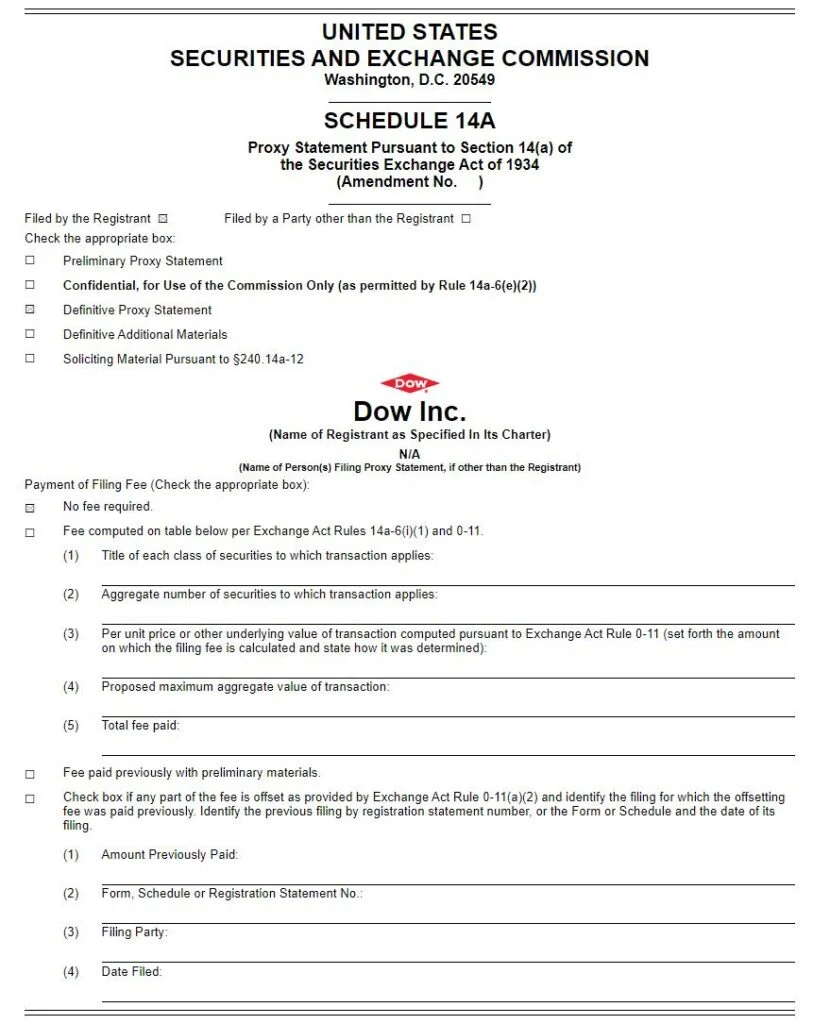

Form DEF 14A, or the definitive proxy statement, is a filing required by the SEC under the Securities Exchange Act of 1934. [1] It provides shareholders with important information about a company’s management, board of directors, executive compensation, and other corporate matters that will be voted upon during the annual shareholder meeting. The form serves as a primary source of information for shareholders to make informed decisions on proxy voting.

Sample of Form DEF 14A

Purpose of Form DEF 14A

Form DEF 14A ensures transparency and disclosure in corporate governance by providing shareholders with the necessary information about the matters to be voted on during the annual meeting. This includes information on board nominees, executive compensation, and proposals from both the company and shareholders. In addition, the form allows shareholders to understand the rationale behind the company’s decisions and assess the performance of its management and board of directors.

Why is Form DEF 14A Important?

- Empowers shareholders with the information needed to make informed decisions when voting on various corporate matters.

- Provides insight into a company’s management, board structure, and executive compensation, which may impact investor confidence and valuation.

- Ensures transparency in corporate governance by requiring companies to disclose essential information.

Key Sections of Form DEF 14A

- Notice of Annual Meeting: Provides the annual shareholder meeting’s date, time, and location.

- Proxy Statement Summary: Summarizes the major proposals to be voted on during the meeting.

- Corporate Governance: Describes the company’s governance structure, including information about the board of directors, board committees, and nomination process.

- Executive Compensation: Presents information on the compensation of the company’s top executives.

- Proposals: Outlines the specific proposals that will be voted on during the meeting, including company and shareholder proposals.

How Can Investors Use Form DEF 14A to Make Investment Decisions?

Investors can use Form DEF 14A to make informed investment decisions by analyzing its information on a company’s corporate governance, board structure, executive compensation, and proposals to be voted upon during the annual shareholder meeting.

Here are some specific ways investors can use Form DEF 14A to make investment decisions:

- Assessing management and board quality: By reviewing the backgrounds, qualifications, and independence of the board members, investors can gain insights into the quality of the company’s leadership. A strong and experienced management team and board can be a positive signal for investors.

- Evaluating executive compensation: The executive compensation section of Form DEF 14A provides a detailed breakdown of the pay packages for top executives, including base salary, bonuses, stock options, and other incentives. Investors can analyze this information to determine if the compensation is fair, aligned with company performance, and incentivizes executives to create long-term shareholder value.

- Monitoring corporate governance practices: Form DEF 14A provides information on the company’s corporate governance structure, including board committees, director nomination processes, and risk management. Investors can use this information to evaluate the company’s commitment to strong governance practices, which can positively impact the company’s performance and reduce potential risks.

- Analyzing shareholder proposals: The form outlines shareholder proposals, allowing investors to gauge the level of shareholder activism and engagement in the company. If the management responds positively to constructive shareholder proposals, it can indicate a willingness to improve corporate governance and address potential concerns.

- Understanding company strategies and goals: Form DEF 14A can provide insight into the company’s strategic direction, as proposals often outline management’s plans and objectives. This information can help investors assess whether the company’s strategy aligns with their investment goals and expectations.

- Comparing with industry peers: Investors can compare the information disclosed in Form DEF 14A with that of industry peers to determine how the company’s governance practices, executive compensation, and board structure compare to its competitors. This can help identify potential strengths and weaknesses in the company’s approach to governance and management.

Form DEF 14A FAQs

Some common questions investors may have about Form DEF 14A include the following:

Can I Vote if I Don't Attend the Annual Meeting?

Yes, shareholders can vote by proxy without attending the annual meeting. Form DEF 14A includes a proxy card or instructions on how to vote online or by phone.

Are All Companies Required to File Form Def 14A?

Only publicly-traded companies registered with the SEC under the Securities Exchange Act of 1934 are required to file Form DEF 14A.

Can I Submit a Shareholder Proposal?

Yes. Eligible shareholders may submit proposals for inclusion in the company’s proxy statement. However, certain SEC rules and company bylaws must be followed.

How Do I Know if the Company's Executive Compensation Is Fair?

Form DEF 14A provides details about the company’s executive compensation, including the rationale behind it. Shareholders can analyze this information and compare it with industry standards or other companies to determine if the compensation is fair.

Where Can I Find a Company's Form Def 14A?

You can find a company’s Form DEF 14A on the SEC’s EDGAR database by searching for the company’s name or ticker symbol and locating the appropriate filing.

The Bottom Line

Form DEF 14A is a crucial document for investors and stakeholders to understand a company’s corporate governance, board structure, executive compensation, and various proposals that will be voted on during the annual shareholder meeting.

By reviewing this form, shareholders can make informed decisions when voting on critical matters that may impact the company’s performance and value. As a result, Form DEF 14A plays a vital role in promoting transparency and accountability in corporate governance.

Sources

At ACDS Publishing, we hold ourselves to the highest standard of accuracy and credibility, ensuring that our readers receive only the most verifiable and substantiated information. To achieve this, we rely on a rigorous approach that involves sourcing information from reliable primary sources, including white papers, government data, original reporting, and expert interviews. By employing these methods, we strive to deliver factual and authoritative content that our readers can confidently trust.

- U.S. Securities and Exchange Commission. “Proxy Statements: How to Find.” Retrieved from https://www.investor.gov/introduction-investing/investing-basics/glossary/proxy-statements-how-find

Get newsletter updates from Alex

No spam. Just the highest quality ideas that will teach you how to build wealth via the stock market.