Understanding Personal Financial Statements: A Comprehensive Guide

Table of Content

- What’s in This Guide?

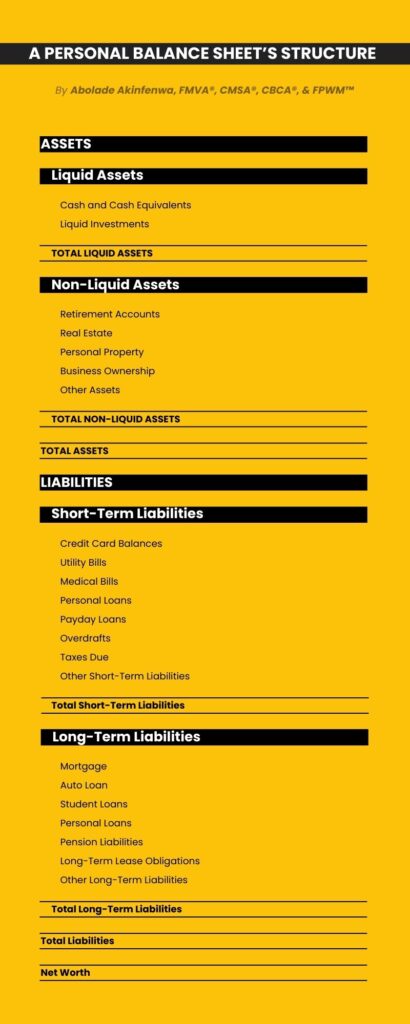

- Personal Balance Sheet

- How to Create a Personal Balance Sheet

- Calculating and Interpreting Your Net Worth

- Pros of Creating a Personal Balance Sheet

- Personal Balance Sheet Limitations

- Pro Tips on Creating and Maintaining a Personal Balance Sheet

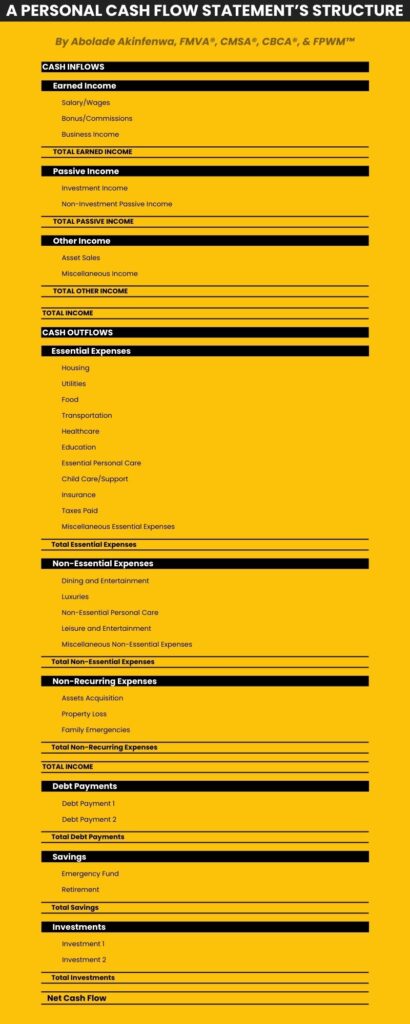

- Personal Cash Flow Statement

- How to Create a Personal Cash Flow Statement

- Calculating and Interpreting Your Net Cash Flow

- Pros of Creating a Personal Cash Flow Statement

- Personal Cash Flow Statement Limitations

- Pro Tips on Creating and Maintaining a Personal Cash Flow Statement

- Personal Balance Sheet Case Study

- Personal Cash Flow Statement Case Study

- Grab Your Free Personal Financial Statement Template Here!

- The Bottom Line

Financial literacy isn’t just a skill; it’s a necessity in our complex modern economy. Our financial landscape is filled with many challenges—from managing debt and investments to planning for retirement. A personal financial statement is one key financial document that makes navigating these challenges easy.

Personal financial statements, which comprise a balance sheet and cash flow statement, provide a snapshot of your financial health, allowing you to evaluate your current financial condition, track changes over time, and plan for the future. Imagine seeing, at a glance, areas where you can reduce spending, if your net worth is increasing or decreasing, or if you are on track to meet your financial goals.

That’s the kind of clarity these statements provide. They don’t just contain numbers; they provide insights into your financial health, facilitating better decisions and effective long-term planning. For example, a cash flow statement can reveal if you are spending too much on non-essential items, while a balance sheet can show if your debt is becoming unmanageable.

Additionally, analyzing these statements together provides a broad view of your financial situation, helping you identify potential issues before they become significant problems. For instance, if your cash flow statement shows a consistent surplus, but your balance sheet reveals increasing debt, that might be a sign that you are not using your surplus efficiently to pay down debt.

What’s in This Guide?

In this guide, we’ll walk you through the two common types of personal financial statements: the personal balance sheet and the personal cash flow statement. We’ll explain each statement, their typical line items, the benefits of creating them, and their limitations.

CASH OUTFLOWS

ESSENTIAL EXPENSES

- Rent: $1,200

- Groceries: $300

- Utilities: $200 (including electricity, water, and internet)

- Gas (for transportation): $120

- Health Insurance (deducted from her salary): $120

- Car Insurance: $90

- Personal Care (haircuts, toiletries): $60

- Public Transportation: $50

- Total Essential Expenses: $2,140

NON-ESSENTIAL EXPENSES

- Dining Out: $250

- Miscellaneous Purchases: $100

- Gym Membership: $50

- Gifts: $50

- Streaming Services (Netflix, Spotify): $25

- Total Non-Essential Expenses: $475

DEBT PAYMENTS

- Student Loan Repayment: $300

- Car Loan Payment: $200

- Credit Card Minimum Payment: $100

- Personal Loan from a Friend: $100

- Total Debt Payments: $700

SAVINGS

- Savings Account Contribution: $500

- 401k Contribution: $225 (5% of her gross salary)

- Total Savings: $775

INVESTMENT

- Investment into Index Funds: $200

- Total Investments: $200

- Total Cash Outflows: $4,140

- Net Cash Flow: $959

Interpretation and Action

Upon completing her personal cash flow statement, Sarah is relieved to see a positive net cash flow of $959. This positive net cash flow means she’s living within her means and has a surplus after paying all monthly obligations.

However, she recognized that $300 of the surplus was from a one-time sale of her old laptop—an irregular form of income. This meant that her consistent net cash flow was actually $659—give or take a couple of dollars due to the unpredictable nature of her non-investment passive income.

With this in mind, she decided to further allocate her net cash flow towards:

- Caution with Irregular Income: She decided not to rely on her asset sale for recurring monthly expenses. Instead, she’d treat such irregular income as a bonus.

- Debt Acceleration: In a bid to reduce high-interest liabilities faster, Sarah allocated an additional $395.40 (or 60% of her monthly disposable income) from her regular surplus towards her credit card debt, increasing the monthly payments to $495.40. By so doing, she will pay off the debt within five months, as long as she doesn’t incur any more credit card debt.

- Emergency Fund Boost: After accounting for the credit card payment, she decides to save an extra $131.80 (20% of $659) from her regular surplus to her emergency fund, bolstering her financial safety net.

- Personal Loan Payoff Strategy: Remembering the personal loan she took for a family emergency, she committed to allocating 20% of her monthly disposable income to repay it faster. This would amount to $131.80 (20% of $659) every month, in addition to the $100 she currently pays, taking the total monthly payment to $231.80. Sticking to this payment strategy will help her pay off the loan within five months, as opposed to the initial ten.

- Non-Essential Expenditures Review: Sarah observed that her dining out expenses were relatively high. So, she decided to reduce it by $100 (40%) and divert that amount towards her student loan repayment. Doing so will help her pay off the loan three years earlier and save $2,868 in interest payments.

- Car Loan: Sarah realized that by paying $200 monthly, she was already on track to pay off her car loan within four years, three years earlier than her loan term, saving $1,270 in potential interest payments.

- Passive Income: Seeing the success of her personal design blog, Sarah considered investing more time to increase her advertising and affiliate marketing income.

Benefits Sarah Gained From Creating a Personal Cash Flow Statement

- Enhanced Financial Awareness: Sarah better understood her financial status after creating her cash flow statement. This exercise helped her spot patterns, such as her monthly takeout habit, making her reconsider her spending decisions.

- Precise Goal Setting: Sarah found it easier to set financial targets once she knew her disposable income. This ensured she wasn’t setting herself up for failure but creating realistic and achievable financial objectives.

- Effective Debt Management: Completing the cash flow statement, Sarah was better poised to manage her multiple debts. Recognizing the prudence of paying off high-interest debts first, she drafted a strategic repayment plan, saving herself from additional interest accumulation.

Limitations Sarah Overcame

- Temporary Snapshot: Sarah understands that the cash flow statement provides data for a specific period. Thus, she plans to review and update hers regularly to monitor financial changes over time.

- Wealth Indication: Aware that the cash flow statement doesn’t reflect total wealth, Sarah complements it with a personal balance sheet to gauge her overall financial health.

- Expenditure Accuracy: Sarah addresses the challenge of overlooked expenses by meticulously tracking every penny, often using financial tracking apps for accuracy.

Pro Tips Sarah Followed

- Regular Review: Sarah plans to diligently review her cash flow statement every month to ensure it’s updated and reflective of her current financial state.

- Digital Assistance: Sarah uses expense-tracking apps to automatically categorize and track her inflows and outflows to streamline the process.

- Emergency Preparedness: Sarah maintains an emergency fund, understanding the unpredictability of life events.

Conclusion

Creating a personal cash flow statement was yet another financial eye-opener for Sarah. Just as the personal balance sheet had given her insight into her net worth, the cash flow statement offered her a clear view of her monthly financial activities. She could see where her money came from and where it was going, ensuring she wasn’t merely flying blind when managing her monthly expenses and income.

Sarah’s positive net cash flow is encouraging, and her decisions to accelerate debt repayment and consistently increase her savings demonstrate both proactiveness and foresight. Armed with the insights from her cash flow statement, she is now even more committed to fortifying her financial resilience, ensuring she is not just living for the present but is also well-prepared for the future.

Grab Your Free Personal Financial Statement Template Here!

Want a hassle-free way to monitor your finances? Download our free personal financial statement template. Easy to use and fully customizable—it’s everything you need to keep track of your assets, liabilities, and cash movements.

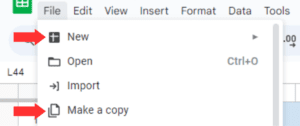

How to Use the Template

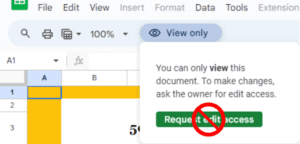

The template is a view-only file and can’t be edited. To use, click on “File” and then select “Make a copy.” This will get you a copy of the template that can be modified.

Don’t request edit access, please.

The Bottom Line

In today’s complex economy, tools like a personal balance sheet and a cash flow statement aren’t just nice to have—they’re essential for understanding and navigating your finances.

Think of the balance sheet as a still photo, capturing your assets and liabilities in one snapshot. It allows you to calculate your net worth and can highlight areas for improvement. In contrast, the cash flow statement is like a movie, illustrating the dynamic movement of your funds and providing insights into your liquidity and spending habits.

Individually, these statements offer valuable insights, such as revealing if you’re splurging too much on non-essentials or if debts are becoming unmanageable. Yet, when combined, they paint a comprehensive picture of your financial standing and habits. This dual perspective ensures you know your financial status and how your habits shape it.

As illustrated by the case studies, creating these financial statements is simple, especially with the templates provided in this guide. These templates simplify the process of creating these statements with their auto-calculating fields and intuitive categories. They guide you through the process, minimizing errors. Remember, keeping these statements updated is vital to ensuring you’re on track with your financial goals, be it budgeting, retirement planning, or merely gauging your fiscal health.

Feel free to work with a financial planner or advisor if you find it challenging to decipher and leverage insights from your financial statements. Not only can they assist you in understanding these statements, but they can also offer personalized strategies tailored to your unique financial situation. Beyond helping you interpret these statements, they can also advise on investments, tax planning, and other aspects of financial management that might be outside your comfort zone.

By understanding, creating, and maintaining these personal financial statements, you’ll have the tools to navigate your financial journey, align your financial habits with your goals, and build a secure financial future.

Remember, maintaining and reviewing these statements regularly is as important as their initial creation. As your financial situation evolves—like with a new job, added expenses, or changes in investments—your statements should reflect those shifts to offer accurate insights. So, watch those numbers, make wise choices, and remember—you’ve got this!

About the Author

Abolade Akinfenwa is a multi-certified finance professional. He’s certified as a Financial Modeling & Valuation Analyst (FMVA)®, Capital Markets & Securities Analyst (CMSA)®, Commercial Banking & Credit Analyst (CBCA)®, Financial Planning & Wealth Management Professional (FPWM)™, and FinTech Industry Professional (FTIP)™. With over three years of experience as a Financial Writer, Abolade specializes in helping finance professionals build authority and generate qualified leads for their services. Interested in collaborating or seeking insights? Connect with Abolade via LinkedIn or Twitter, or email him at [email protected].

Get newsletter updates from Alex

No spam. Just the highest quality ideas that will teach you how to build wealth via the stock market.

A personal balance sheet provides a snapshot of your financial position at a specific period, typically a month or a year. It outlines what you own (assets), what you owe (liabilities), and the difference between the two, known as your net worth. Assets include your house, car, investments, and savings, while liabilities encompass debts such as your mortgage, car loan, and credit card balances.