How to Plan Your Finances Using the 50-30-20 Budgeting Rule (Plus Case Study and Free Template)

Table of Content

- What is Budgeting?

- What Is the 50-30-20 Budgeting Rule?

- Why Financial Experts Swear by the 50-30-20 Budgeting Rule

- How to Create a 50-30-20 Budget

- Pro Tips for Budgeting Success

- Common Budgeting Challenges and Solutions

- Case Study: Sarah’s Journey With the 50-30-20 Budgeting Rule

- Alternative Budgeting Strategies

- Grab Your Free Budgeting Template Here!

- In Conclusion: Mapping Out Your Financial Journey

Imagine constructing a house without a blueprint or driving to an unfamiliar destination without a map. Sounds risky and challenging, right? That’s the journey you undertake when you manage your finances without a budget. A budget is your financial blueprint and map: it ensures you direct your resources effectively, make informed decisions, and remain on track to achieving your financial goals.

Creating and maintaining a budget helps you prioritize spending, avoid debt, save for the future, and attain financial peace. So, how exactly do you create one?

One popular method that has stood the test of time and remains highly relevant in today’s fast-paced world is the 50-30-20 budgeting rule. This budgeting strategy entails allocating 50% of your income to needs, 30% to wants, and 20% to savings, investments, and debt repayment. This budgeting rule stands out due to its universal applicability. It doesn’t demand intricate calculations or constant adjustments, making it an ideal starting point for budgeting beginners and a consistent strategy for seasoned planners.

Whether you earn a lot or a little, this framework scales with you, ensuring you live within your means while paving the way for a secure financial future. Additionally, it’s versatile. Whether you’re entering the workforce, raising a young family, or approaching retirement, the 50-30-20 budgeting rule adapts to your life stages, ensuring that while today is enjoyable, tomorrow is secure.

What’s in This Guide?

In the upcoming sections, we’ll take you through the ins and outs of budgeting, focusing on the 50-30-20 rule and equipping you with practical insights to plan your finances effectively. We’ll also examine a case study to give you a real-world perspective on applying these principles. Finally, you’ll find a free, comprehensive budgeting template waiting for you at the conclusion of this guide to kick off your journey.

Ready to jump in? Let’s go.

In a hurry and can’t read this guide in one go? Download the free PDF version to read whenever you have the chance!

What is Budgeting?

Budgeting entails creating a plan that ensures you’re financially prepared for necessities and indulgences. It involves allocating your income towards various expenses, ensuring that essential costs are covered, future savings are set aside, and you can still enjoy life’s pleasures. When you create and stick to a budget, you take control of your finances, allowing yourself to see where every dollar goes and making conscious decisions about spending and saving

Contrary to popular belief, budgeting is not about penny-pinching but ensuring every dollar is accounted for and used purposefully. Having a clear financial vision, especially in a consumer-centric world with numerous spending temptations, helps you discern between fleeting wants and genuine needs. With a budget, you’re not just hoping to make ends meet; you’re ensuring they do.

While some perceive budgeting as restrictive—picturing it as a chain holding them back from enjoying life—it’s actually a tool that helps you spend responsibly. For instance, budgeting doesn’t necessarily mean eliminating luxuries like morning coffees or weekend getaways. Instead, it promotes informed decision-making, ensuring you can indulge in life’s pleasures without jeopardizing your well-being. For example, you might decide to skip daily store-bought coffees to save for an extravagant weekend outing.

What Is the 50-30-20 Budgeting Rule?

The 50-30-20 budgeting rule was popularized by Elizabeth Warren, a U.S. Senator and former Harvard bankruptcy expert, in her book “All Your Worth: The Ultimate Lifetime Money Plan” co-authored with her daughter, Amelia Warren Tyagi.

Warren, with her extensive experience in bankruptcy and law, combined with Tyagi’s financial expertise, brought a nuanced yet straightforward perspective to personal budgeting. In their book, which was published in January 2006, they shared an intuitive way of managing money that entailed divvying it into three categories:

- the “Must-Haves” (bills you have to pay every month),

- the “Wants” (fun money for right now), and

- your Savings (to build a better tomorrow).

This big-picture approach to managing money with simple, high-level guidelines has since evolved into a widely adopted financial rule. Many have adopted and adapted this rule over the years, appreciating its simplicity and effectiveness. Additionally, financial planners often recommend variations of this rule tailored to individual needs and financial circumstances. In the following sections, we’ll examine each component of the 50-30-20 budgeting rule in more detail.

50%: Needs

Budgeting primarily involves prioritizing your essential expenses—the non-negotiables that keep your life running smoothly. Per the 50-30-20 budgeting rule, you should allocate half of your after-tax income to your needs and obligations.

Spending more than that on your essential expenses is a sign that you may need to make some lifestyle changes to bring your “needs” under the sustainable 50% threshold. It’s also a sign that you may need to trim your non-essential expenses to reallocate funds to cover your essential expenses without overshooting your overall budget.

Examples of “needs” that are typically prioritized when creating a budget include but aren’t limited to the following:

- Housing: This category covers housing-related expenses such as rent for an apartment or a mortgage for a home.

- Utilities: Think of water, electricity, and gas bills. Additionally, in today’s digital age, an internet connection, especially for remote work, often falls under this category.

- Transportation: This category includes car payments, fuel, public transportation costs, regular maintenance, and other transport-related expenses to get to work, school, or other essential places.

- Childcare: For parents, childcare, including daycare fees, babysitter costs, and after-school programs, is often a non-negotiable expense.

- Groceries: Essential food items for you and your family come under this category.

- Healthcare: Beyond out-of-pocket medical expenses, this category includes prescription medications, regular check-ups, and other health-related costs.

- Education: For those pursuing education or with children in school, this category can encompass tuition fees, school supplies, uniforms, and other related educational costs.

- Clothing: This includes essential clothing required for daily life, such as work uniforms or winter coats.

- Personal Care: This category covers indispensable hygiene products such as toothpaste, soap, shampoo, deodorant, lotions, essential cosmetics, and other products required for daily personal upkeep.

- Insurance: This category includes health insurance (a shield against overwhelming medical costs), car insurance (a legal requisite and financial safeguard), homeowners or renters insurance (your hedge against potential property mishaps), and life insurance (a security net ensuring your family’s financial well-being during unforeseen events).

- Minimum Debt Payments: This category accounts for all monthly minimum debt payments. Most debts, like credit card dues and student loans, have monthly minimum payments. Failure to pay them would negatively affect your credit score, and depending on the debt, you might incur extra interest and penalties. For this reason, monthly minimum debt payments are usually considered a “need.”

How to Differentiate Between “Needs” and “Wants”

It’s sometimes tricky to separate genuine needs from mere desires. Here’s a strategy: Ask yourself, “Can my daily life function without this?” If the answer is “no,” it’s likely a “need.” To illustrate, while a basic phone plan might be needed for communication, upgrading to the latest smartphone model when your current one works just fine is likely a “want.” Another litmus test is to consider the consequences of forgoing a particular expense. If going without something would jeopardize your safety, health, or well-being, it undeniably qualifies as a “need.”

The Classification of “Needs” and “Wants” Depends on Your Personal Circumstances

It’s vital to note that what you classify as a “want” or “need” depends on your personal circumstances. This is because what you categorize as a “need” might be a “want” for someone else, and vice versa. For instance, as a professional who relies on up-to-date tech for their job, a high-performance computer or a specific software subscription might be a “need” for you. However, for someone in a different profession, the same could be a luxury, a “want.”

Furthermore, as you progress through different life stages—moving to a city, starting a family, or transitioning to retirement—your definition of necessities and luxuries will shift. For example, a young professional living in New York City might consider a monthly metro card essential, as public transportation is the most efficient way to navigate the city. Conversely, a couple moving to the suburbs to raise a family might need a reliable family car to manage everyday commutes, children’s school, and extracurricular activities.

30%: Wants

“Wants” are items and experiences that enhance and add value to your life but aren’t necessary for survival. They’re expendable, and you can reduce or eliminate them if the need arises.

According to the 50-30-20 budgeting rule, you should allocate 30% of your after-tax income towards these non-essential expenses. By prioritizing and being mindful of these “wants,” you can live within your means, establish a financial safety net, and avoid potential debt.

Here are some examples of what qualifies as a “want”:

- Entertainment & Leisure: This category covers non-essential activities or services that provide enjoyment and relaxation. For instance, catching the latest movie, attending live concerts, subscribing to Netflix or Spotify, buying that novel you’ve been eyeing, or purchasing hobby-related materials are all classified as “wants” under this category.

- Dining Out & Takeaways: While food is a “need,” dining at restaurants frequently or ordering takeout is a luxury. Weekly dinners at restaurants, sipping on a Starbucks latte daily, and ordering that weekend pizza are all “wants” related to this category.

- Gadgets & Electronics: This category covers the latest tech products or electronic items that offer optional enhanced user experiences. Buying the newest iPhone, splurging on state-of-the-art headphones, ordering virtual reality headsets, and getting the latest PlayStation are all “wants.”

- Luxury Items: High-quality items, often branded, represent a choice for luxury over necessity—a choice of status over functionality. Designer handbags, luxury watches, high-end brand clothing, etc., are “wants” that fall under this category.

- Hobbies & Extracurricular Activities: These cover activities or items you enjoy during your free time. Whether it’s investing in professional photography gear, art supplies for painting, joining a prestigious golf club, or acquiring a new musical instrument, these are all considered “wants.”

- Beauty & Cosmetics: This category goes beyond essential grooming to cover products or services that enhance one’s appearance. Think premium makeup brands, spa treatments, elective cosmetic surgeries, monthly nail salon visits, etc.

- Home Décor & Furnishings: While shelter is a fundamental need, accessorizing and upgrading one’s space beyond necessities is a luxury. This includes purchasing intricate artwork, designer lamps, plush furniture from high-end brands, or exotic rugs.

- Fashion & Accessories: Clothing is essential, but keeping up with the latest fashion trends and expanding one’s wardrobe with branded items is a choice. This can involve refreshing wardrobes with seasonal fashion lines, shading your eyes with designer sunglasses, stepping out in luxury footwear, and splurging on high-end jewelry.

- Fitness & Wellness: While basic fitness is essential, certain premium services and products are considered “wants.” This can range from exclusive fitness studios and premium organic superfoods to specialized workout gear and wellness retreats.

- Travel & Adventures: This category covers explorations and thrill-seeking activities. Whether it’s a European tour, an adventure-packed ski trip, a deep-sea diving expedition, a luxurious cruise, or jumping off a plane, these are categorized as “wants” here.

- Gifts & Generosity: While giving brings joy, sometimes the magnitude can tip it into your budget’s “wants” section. Examples include gifting high-value items for birthdays or anniversaries, making generous donations to various charities annually, and organizing and bearing the costs of opulent celebrations or parties.

The Importance of Allowing Room in Your Budget for Fun and Leisure

Being fiscally responsible is vital. However, consistently denying yourself leisure can lead to burnout or feeling like you’re on an endless financial treadmill. By setting aside a portion of your budget for “wants,” you reward yourself for your diligence and promote a more sustainable and mentally healthy approach to financial planning.

It’s crucial to remember, in line with the 50-30-20 budgeting rule, that the portion set aside for “wants” should ideally not exceed 30% of your after-tax income. This balance ensures you can enjoy life’s offerings while being financially prudent.

One practical tip for managing “wants” is to prioritize them. List all your desired “wants,” then rank them based on your preferences and the value they add to your life. Allocate your budget starting from the top of the list, ensuring that your spending aligns with what matters most to you.

20%: Savings, Investments, and Debt Repayment (SIDR)

Following the 50-30-20 budgeting rule, you should channel the remaining 20% of your after-tax income to SIDR. How you allocate the funds across these categories depends on your current financial situation, goals, and the specific circumstances you face. Here’s a brief breakdown to help you prioritize this allocation effectively:

Emergency Fund (Savings)

Priority: High (especially if you don’t have one yet).

An emergency fund is your first line of defense in financial planning. As such, you should prioritize establishing one by regularly allocating a portion of your SIDR allocation to build this reserve.

Consider your monthly living expenses to determine how large your emergency fund should be before you begin investing and aggressively paying down debts. Aim for a fund that can cover three to six months’ worth.

Having an emergency fund that can cover at least three to six months’ worth of your monthly expenses ensures you’re prepared to handle unforeseen events, such as medical emergencies, sudden job losses, or urgent repairs, reducing the need to rely on credit or compromise your long-term savings and investment goals.

Make it a habit to review and adjust your emergency fund periodically, ensuring it aligns with your current financial situation and needs.

Consider this scenario: Jenn is a recent college graduate with student loans and zero savings. Before considering investing or making extra payments on her loans, Jenny should build an emergency fund to cover 3-6 months of expenses. Doing this ensures she won’t need more debt if unexpected expenses arise.

High-Interest Debt Repayment

Priority: High (after an emergency fund is in place).

After establishing a safety net, identifying and eliminating high-interest debt should be your next focus. High-interest obligations, particularly from credit cards, can accumulate quickly, slowing your financial progress. Therefore, paying off high-interest debt is often more beneficial than investing.

The logic is straightforward: when the interest on your debt exceeds potential investment returns, prioritizing debt repayment is generally wiser. This is because the interest saved is typically higher than average investment returns. To illustrate, the average interest rate on new credit card offers in the U.S. as of September 2023 is 24.45% [1], which is significantly higher than average investment returns from most asset classes.

After saving up three to six months’ worth of your monthly expenses, develop a systematic plan to pay more than the minimum monthly requirement to minimize the interest accrual. Think you don’t have extra money for that? Assess your budget to find areas to reduce non-essential expenses and redirect those funds to pay off high-interest debts faster.

You could also consolidate or refinance your high-interest debt to get a lower interest rate. Doing either will reduce your monthly interest charges and help you pay off the debt more efficiently.

Consider this scenario: Maria has $3,000 in credit card debt at an 18% interest rate and a student loan of $15,000 at a 4.99% interest rate. What should she do? She should prioritize repaying the credit card debt before making extra payments toward her student loan or investing because the credit card debt costs her more in interest.

Investments

Priority: Moderate to High (once high-interest debts are under control).

Investing is a vital strategy for long-term financial growth. The earlier you start, the more you benefit from compound interest, which means earning interest on the already-earned interest. It’s crucial, however, to have a strong financial foundation before diving in.

Allocate funds for investments only after building an emergency fund and tackling high-interest debts. This approach ensures potential market downturns don’t force you into debt or deplete your savings. It also ensures you have a safety net to fall back on during emergencies and that interest payments don’t erode your investment returns.

Consider this scenario: After setting aside six months’ worth of expenses and paying off his high-interest debts, David has some extra money. He decides to invest in an index fund, which historically has returned about 7% annually. Over time, his investments will grow, outpacing the interest he would have incurred on his debts.

Low-Interest Debt Repayment

Priority: Moderate.

Tackling low-interest debts requires a more strategic approach. While always meeting minimum payments is crucial for maintaining a good credit score, accelerating repayment of such debts might not always be the best financial decision. This is because the interest on these debts is often manageable and doesn’t significantly erode your income.

As such, it’s worth evaluating the opportunity cost: could the extra money you’re considering for debt repayment generate a better return elsewhere, like in an investment?

Examine the interest rate on your low-interest debts and compare it with expected investment returns. If the rate is low, consider channeling excess funds into investments that yield higher returns.

Consider this scenario: Emily has a mortgage with a 3.99% interest rate to be paid off within seven years and a decade left till she retires. Instead of making extra mortgage payments, she decides to invest more in her retirement account, expecting a higher return over the long term.

Other Savings Goals

Priority: Varies based on individual goals (after an emergency fund has been set up and high-interest debts have been repaid).

Life comes with various milestones and aspirations, each carrying its price tag. Whether it’s a down payment on a house, a child’s education, a retirement nest egg, or a vacation, each goal requires diligent saving. However, before channeling money into these goals, address critical financial concerns, like high-interest debt and an emergency fund.

Keep an eye on your budget to avoid overextending yourself. Regularly assess the importance and urgency of each goal to prioritize your savings effectively. Remember, it’s crucial to maintain a balance—saving for the future shouldn’t come at the expense of your present financial stability.

Consider this scenario: After clearing her high-interest debt, saving up at least six months’ worth of expenses, and investing in her retirement fund, Priya decides to allot a portion of her SIDR allocation to save for a down payment on her first home.

Why You Should Save, Invest, and Prioritize Debt Repayment

Achieving financial stability requires a trifecta approach: saving for security, investing for growth, and repaying debt for freedom. Together, the trio ensures a solid foundation for your financial future. Let’s briefly examine the importance of each approach.

Importance of Savings

Emergency Buffer: By consistently saving a portion of your income, you can build a robust emergency fund. This fund acts as a financial buffer, ensuring that unexpected expenses, such as medical emergencies or sudden auto repairs, don’t derail your financial stability or force you into debt.

Goal Attainment: Directing a set percentage of your earnings into a savings account enables you to accumulate the necessary funds to reach your financial milestones. Whether a home down payment, a vacation, or a significant purchase, saving ensures you can meet these goals without taking on high-interest debts.

- Financial Stability: Making a habit of saving prepares you for emergencies, helps in achieving specific goals, and fortifies your overall financial well-being. With regular savings, you minimize the need to rely on credit cards or loans for unplanned expenses, ensuring a stable, stress-free financial life.

Importance of Investing

Wealth Growth: When you invest your savings, you give your money the potential to grow beyond what a traditional savings account can offer. This amplifies your financial capacity, turning your saved dollars into a more substantial sum over time, accelerating wealth accumulation.

Passive Income: By selecting the right investment vehicles, like bonds and dividend-paying stocks, you can generate an additional income stream without active involvement. This extra income can cover some of your expenses, reducing the pressure on your primary income source and facilitating a more comfortable lifestyle.

- Future Security: Investing is crucial in ensuring you’re financially secure in your later years. As you allocate part of your savings to investments, you’re building a nest egg that will provide for your needs in retirement, ensuring that you can maintain your desired lifestyle without financial strain.

Importance of Prioritizing Debt Repayment

- Financial Relief: Tackling your debts head-on, particularly those with high interest, provides immediate financial relief. It reduces the amount of your income dedicated to interest payments, allowing you to use your money for other pressing needs and goals. It’s a direct path to reclaiming your financial freedom.

- Credit Score Boost: Paying off your debts on time and reducing your debt balance impacts your credit score positively. A higher score boosts your financial reputation and ensures you get favorable terms, such as lower interest rates, when you need to borrow in the future.

- Increased Savings and Investments: Eliminating debt frees up a significant portion of your income. You can then channel such income into your savings and investments. With more money saved and invested, you’re better positioned to handle emergencies, achieve financial goals, and build a stable, secure financial future.

Why Financial Experts Swear by the 50-30-20 Budgeting Rule

With a plethora of budgeting techniques available, you may be curious about financial experts’ consistent recommendation of the 50-30-20 budgeting rule. Here’s why:

Straightforward Implementation

Financial experts often recommend the 50-30-20 budgeting rule because of its sheer simplicity. Instead of juggling numerous categories and formulas, you only need to remember three numbers. For example, if you earn $5,000 a month, using the 50-30-20 budgeting rule, you’d allocate $2,500 to needs, $1,500 to wants, and $1,000 to savings, investments, and debt repayment. This clarity helps you quickly set up and stick to your budget, eliminating the guesswork.

Balanced Financial Approach

The 50-30-20 budgeting rule promotes financial balance. By dedicating 50% of your income to needs, 30% to wants, and 20% to savings, investments, or debt repayment, you ensure that you’re not only taking care of your present necessities but also enjoying life and preparing for the future. Let’s say you’ve been eyeing a new pair of shoes. With this rule, you can indulge occasionally without guilt, knowing you’re also saving for the future.

Adaptable to Your Personal Circumstances

Financial professionals routinely recommend the 50-30-20 budgeting rule because of its high level of adaptability. The percentages aren’t set in stone—you can modify them based on your current circumstances, priorities, and financial goals.

For example, if you’re aggressively saving for a short-term goal, such as buying a house or preparing for a sabbatical, you might want to allocate more than the suggested 20% to your savings. Conversely, someone with fewer immediate financial responsibilities might earmark more than the recommended 30% to their “wants.”

On the other hand, an individual deep in high-interest debt might prioritize allocating more than 20% of their income to debt repayment to escape the growing interest, temporarily reducing the percentage allocated to wants.

This flexibility means you can mold the rule to fit your unique financial situation, goals, and priorities.

Applicable to Different Income Brackets

Financial professionals endorse the 50-30-20 budgeting rule because it’s applicable to all income brackets. You can adopt the budgeting rule regardless of how much you earn. Whether you’re a recent graduate starting on an entry-level salary or a seasoned professional making a six-figure income, the principle remains the same. What changes is the absolute value of each category, not the foundational logic.

Ensures Long-term Financial Security

Financial experts often stress the importance of looking ahead and adhering to the 50-30-20 budgeting rule helps you do this. By consistently setting aside a portion (ideally not less than 20%) of your income, you’re building a financial safety net. Whether it’s an unexpected medical bill, a job loss, or an urge to embark on a spontaneous adventure, your savings and investments can be your lifeline or a ticket to life’s memorable experiences.

Encourages Fiscal Responsibility

Financial experts encourage the adoption of the budgeting rule because it stimulates financial mindfulness, which promotes financial responsibility. Adopting the 50-30-20 budgeting rule makes you more conscious of your spending habits. This awareness, in turn, compels you to make financially responsible choices. For instance, when contemplating whether to purchase the latest smartphone, you might reconsider if your current phone works fine.

By adopting this budgeting rule, you’ll be more likely to make prudent financial decisions, ensuring you live within your means while setting aside funds for a rainy day or future aspirations.

Encourages Regular Financial Reviews

Financial professionals recommend the 50-30-20 budgeting rule because it encourages adopters to review their finances regularly. As you adjust the rule to fit evolving circumstances or goals, you become more proactive about financial planning and more aware of changes in your financial landscape.

How to Create a 50-30-20 Budget

Now that you’ve familiarized yourself with the basics of the 50-30-20 budgeting rule and why adopting it makes a lot of sense, it’s time you learn how to create a personalized budget in four straightforward steps.

Step 1: Calculate Your Monthly After-Tax Income

Begin by calculating your total monthly income. Include your salary and any additional income streams you have, then subtract the taxes. It’s essential to use your net income as it represents the actual funds available to you for allocation.

Here’s the formula for calculating your monthly after-tax income:

- Total Monthly Income — Taxes = After-Tax Income

Suppose your monthly income is $4,385, and taxes are $438.5; yoaur after-tax income would be $3,946.5.

Step 2: Identify Your Needs

Following that, list all your essential expenses, including rent/mortgage, utilities, groceries, health insurance, minimum debt payments, etc. To allocate the right portion of your after-tax income to essential needs, use this simple formula:

- After-Tax Income × 0.50 = Allocation for “Needs”

Using the same after-tax income from the preceding example, your allocation for this category would be $1,973.25 ($3,946.5 × 0.50). If your “needs” exceed this allocation, consider reducing costs, such as cutting utility bills or reconsidering your housing options.

Step 3: Categorize Your Wants

Afterwards, identify your non-essential expenses like dining out, entertainment, hobbies, and other personal spending. To figure out how much of your after-tax income should be allocated to this category, use the following formula:

- After-Tax Income × 0.30 = Allocation for “Wants”

Using the same after-tax income from the preceding example, your allocation for this category would be $1,183.95 ($3,946.5 × 0.30). Monitor this category closely; it’s easy to overspend here. If you find yourself exceeding the allocation limit, reassess your spending habits, prioritizing needs and financial goals over non-essential expenses

Step 4: List Cash Outflows Related to Savings, Investment, and Debt Repayment

Next, outline your savings, investments, and debt payments. To figure out how much of your after-tax income should be allocated to this category, use the following formula:

- After-Tax Income × 0.20 = Allocation for “SIDR”

Using the same after-tax income from the preceding example, your allocation for this category would be $789.3 ($3,946.5 × 0.20). Make it a habit to assess and adjust this portion of your budget routinely. As debts decrease, redirect more funds towards savings and investments to build wealth and ensure financial stability in the long term.

Pro Tips for Budgeting Success

Creating an effective budget is more than just numbers—it’s about adopting the right mindset, using digital tools, and being proactive in your approach. Here are nine practical tips to ensure you’re on the right path from the get-go.

Create Personal Financial Statements

To create an accurate, personalized budget, you must have a reliable record of your income, expenses, assets, and liabilities. This is where a personal balance sheet and cash flow statement come in.

A personal balance sheet tracks your assets (what you own) and liabilities (what you owe). In contrast, a personal cash flow statement records your cash inflows (income) and cash outflows (expenses).

Having a personal balance sheet and cash flow statement makes it easier for you to create a budget. This is because data from both financial statements directly feeds into your budget. The balance sheet reveals your savings, investments, and debt obligations, while the cash flow statement highlights your essential (needs) and non-essential expenses (wants).

To learn how to create, interpret, and maintain both personal financial statements, check the Recommended Reading section.

Clearly Define Your Financial Goals

When it comes to taking control of your finances, having well-defined goals is paramount. These goals become the backbone of your budget, offering clarity, purpose, and motivation to adhere to your financial plans. The more specific and actionable your goals are, the higher your chances of achieving them. This is where the SMART framework, an effective goal-setting strategy, comes into play.

S – Specific:

- Old Goal: “I want to save money.”

- SMART Goal: “I want to save for a new car.”

M – Measurable:

- SMART Goal Addition: “I want to save $10,000 for a new car.”

Ensure your goal is measurable. Attach a precise figure to your goal. Instead of “I want to save for a new car,” make it measurable: “I want to save $10,000 for a new car.” This makes tracking your progress straightforward and allows you to make necessary real-time adjustments.

A – Achievable:

- SMART Goal Addition: “…by cutting down on dining out and allocating a portion of my monthly bonus towards the savings.”

Identify specific actions that will help you achieve your goal. Ensure it’s realistic and attainable based on your income, expenses, and other financial obligations. For instance, if you can only set aside $200 a month based on your current budget, then saving $10,000 in a short period might be a stretch. Adjust your goals so they are challenging yet achievable.

R – Relevant:

- SMART Goal Addition: “…for a new car, which is essential for my daily commute to work.”

Ensure your goal aligns with your current life situations and long-term plans. Saving for a new car should be relevant to your immediate needs and overarching life priorities, adding value and convenience to your daily life. If you don’t have a driving license or don’t intend to drive soon, saving for a car might not be a relevant goal. Instead, saving for another “need” or “want” would be more appropriate.

T – Time-Bound:

- SMART Goal Addition: “…within the next 18 months.”

A deadline is crucial. It introduces a sense of urgency and prompts action. Set a clear timeframe for achieving your goal. If you aim to save $10,000, having an 18-month deadline enables you to calculate monthly saving targets and consistently evaluate your progress.

Full SMART Goal:

“I want to save $10,000 for a new car essential for my daily commute to work by cutting down on dining out and allocating a portion of my monthly bonus towards the savings. I will track my progress monthly, aiming to achieve this goal within the next 18 months.”

By creating SMART financial goals, your budget becomes a living, evolving document grounded in your real-world needs, aspirations, and the tangible steps that bridge today’s choices with tomorrow’s dreams.

Automate Your SIDR

Automation helps you to stay on track with your savings, investments, and debt repayment (SIDR) obligations. Life’s daily hustle and bustle makes it easy for your financial commitments to slip through the cracks. However, when you automate your SIDR, you essentially set your financial growth and debt reduction on autopilot, ensuring consistency and adherence to your goals.

Various tools facilitate effortless financial automation. Digital banking allows scheduled transfers for savings, investments, and bill payments, ensuring the timely allocation of funds. Financial apps offer automatic investment and savings features tailored to your goals and risk tolerance.

Additionally, employer-based payroll deductions allow you to direct a portion of your income to retirement or savings accounts before it reaches your hands. You can also set up standing orders in your bank to automatically transfer funds towards savings, investment accounts, or debts.

Automating the transfer of funds toward your SIDR offers several benefits. For starters, doing so ensures consistent investment, leading to compounded returns over time. It also enforces timely debt payments, boosting your credit score and enhancing your financial reputation. Lastly, it alleviates the mental burden of manual savings and debt repayment, reducing financial stress and fostering a sense of financial security and well-being.

But remember, automation isn’t a “set and forget” mechanism. Consider a bi-annual or annual review to ensure alignment with your evolving financial goals and income. Adjust your automated savings, investments, and debt repayment accordingly as your financial landscape shifts—perhaps due to a raise, a new expense, or a completed financial obligation. Doing so ensures your financial automation remains tailored to your current needs, maximizing its efficiency and effectiveness in helping you achieve your financial goals.

Regularly Review Your Budget

Your budget should be dynamic, not static. As you navigate through different phases of your life, various aspects change—your income, expenses, financial goals, and even unforeseen financial responsibilities. Each change in your life necessitates revisiting and modifying your budget to ensure it remains a relevant and effective tool for managing your finances.

For example, if you land a new job with a higher salary, this positive change should be reflected in your budget. You could channel the increase towards bolstering your savings, accelerating debt repayment, or investing in opportunities that align with your enhanced financial capacity. On the flip side, an unexpected expense, like a medical emergency or urgent home repair, may require a reevaluation and adjustment of your spending in other areas to maintain financial balance.

Also, your financial goals are not set in stone. As you achieve set goals or your priorities shift, updating your budget to reflect these new objectives is crucial. For instance, if you’ve successfully saved for a significant milestone like buying a house or starting a business, it’s time to identify the next goal and adjust your budget accordingly.

Set a reminder to review your budget, perhaps every quarter. This regular check ensures that your financial plan aligns with your current income, expenses, and goals. Use this opportunity to track your progress, identify areas for improvement, and make necessary adjustments. A periodic review fosters a proactive approach, enabling you to stay ahead of changes rather than reacting to them, ensuring that your budget remains a robust tool in steering your financial journey toward your desired destinations.

Keep your budget flexible, adaptable, and attuned to your evolving life circumstances, financial goals, and the broader economic landscape. This adaptability keeps you on track and empowers you to navigate unforeseen financial waters with agility and foresight.

Optimize Your Spending

Being mindful of your spending and looking for avenues to optimize can significantly enhance your financial well-being. Regularly assess your spending habits for potential savings.

For instance, consider your recurring monthly expenses. Assess the necessity and value you derive from each. Take your utilities and subscriptions as an initial focus point. Are there unused gym memberships, magazine subscriptions, or services you can eliminate without impacting your quality of life?

Also, evaluate your shopping habits. Are you purchasing items impulsively or buying things you don’t need? If that’s the case, adopting a more intentional approach, like creating a shopping list before you go out or avoiding online stores during sales, can mitigate unnecessary spending. For every purchase, ask yourself, “Do I need this?” This simple question can serve as a potent filter to curtail extraneous expenses.

Look at your food expenses, too. If dining out or ordering takeout is a significant portion of your budget, consider preparing meals at home. Not only is this often a healthier option, but it’s also more cost-effective. A shift in this habit can translate to substantial savings over time. If you spent $200 monthly on restaurants, reducing this expense by half could free up $1,200 annually.

Additionally, consider transport costs. If you’re spending a considerable sum on fuel or public transport, explore alternatives like carpooling, cycling, or walking, especially for short distances. It’s not just cost-saving but also environmentally friendly and beneficial to your health.

Remember, minor optimizations can culminate in significant savings. Every dollar saved is a dollar that you can direct towards your financial goals, be it paying off debt, building an emergency fund, investing, or saving for a significant future expenditure like a home or education.

So, take a moment every month to review your expenses. Identify areas where cutbacks are possible and reallocate those funds to where they are needed most or can be more productive. By consistently optimizing your spending, you make your money work harder for you and fast-track your journey to achieving your financial goals.

Leverage Digital Tools

Technology can transform budgeting from a daunting task into a streamlined, interactive, and insightful experience. Various budgeting apps and online tools offer customized solutions that can help you track, manage, and optimize your finances. Some of the benefits of using budgeting apps and tools include the following:

- Real-Time Monitoring: Apps like Mint or YNAB provide instant access to your financial data anytime, anywhere. Whether on the go or at home, a glance at your app can provide a comprehensive view of your current financial status, ensuring you stay within your means.

- Customization: Many of these platforms offer customizable budgeting categories and goals. Whether you have specific savings targets, debt repayment plans, or investment goals, these tools can be tailored to suit your unique financial landscape.

- Visualization: Visual aids such as graphs, charts, and pie diagrams provided by these apps can make understanding your spending habits and financial trends more intuitive. A visual representation of where your money goes can be an eye-opener, prompting more conscious spending decisions.

- Expense Breakdown: Detailed categorization lets you see where every dollar is spent. This granular insight can be instrumental in identifying areas where you might be overspending without realizing it.

- Bill Reminders: Missed payments can incur fees and negatively impact your credit score. Many budgeting apps offer bill reminders, ensuring you never miss a due date.

- Community & Resources: Platforms like YNAB have active communities where users share their budgeting tips, success stories, and challenges. Additionally, many apps offer tutorials, articles, and webinars to enhance financial literacy.

By leveraging these digital tools, you enhance your budgeting efficiency and gain deeper insights into your financial behaviors. This proactive approach, supported by real-time data, facilitates more informed decisions, allowing you to align your spending habits seamlessly with your financial goals.

Modify Your Budgeting Percentages if Necessary

The 50-30-20 rule is a general guideline, not a one-size-fits-all solution. It’s essential to remember that your financial circumstances, lifestyle, and goals will significantly influence how you allocate your income.

For instance, if you reside in a high-cost city like New York or San Francisco, necessities like rent, utilities, and transportation might take up more than the recommended 50%. Adjusting your budget to reflect this reality is crucial to avoid feeling strained or stretched too thin.

On the flip side, if your living costs are low, maybe due to shared housing or living in an area with a lower cost of living, you have an opportunity. Instead of increasing your discretionary spending, you could beef up your savings, invest more, or expedite debt repayment. This proactive approach accelerates your journey to financial security and affords you more financial freedom in the future.

In addition, as you progress through life, your financial needs and wants will evolve. You may decide to return to school, start a family, or even switch careers. All these changes can impact your financial allocations, so regularly revisiting and adjusting your budget is essential.

Ultimately, remember that while the 50-30-20 budgeting rule is a valuable starting point, you can tweak these numbers to fit your current financial situation. Your budget should be a flexible tool that adapts to your changing financial circumstances, not a rigid system that adds more stress to your life.

Make necessary adjustments to ensure your budget is an enabling tool that helps, not hinders, your financial progress. Assess and modify it periodically to align with your evolving needs, income changes, and unexpected expenses. Your financial journey is unique; let your budget reflect that.

Embrace Consistency and Discipline

Establishing a budget is just the starting point; adhering to it is where the real challenge lies. Be consistent in tracking your expenses, reviewing your budget, and making informed financial decisions. Discipline is crucial. Your budget outlines your limits and boundaries; adhere to them.

It’s easy to be swayed by impulsive buys or attractive deals. Still, it’s essential to assess every potential purchase against your budget. For instance, a flash sale can easily tempt you. In these moments, pause and evaluate the necessity of the purchase. Is it a “want” or a “need”? If it’s a “want,” does your budget currently accommodate it? If not, walking away is a show of discipline. Always weigh your spending decisions against your broader financial objectives.

Every dollar spent outside your budget is less money for your goals. Whether you’re building an emergency fund, saving for a vacation, or investing for retirement, every bit counts. Keep your eyes focused on these goals. Visual reminders can be helpful—consider having a visual representation of your goals and progress to remind you daily why the discipline is worth it.

Consider setting up mechanisms to bolster your discipline, like a 48-hour rule for non-essential purchases where you give yourself two days to think over the purchase before making a decision. This cooling-off period helps you clarify the difference between an impulsive want and a genuine need.

A consistent and disciplined approach towards budgeting will keep your spending in check and fast-track your journey towards achieving your financial aspirations. Every decision aligned with your budget amplifies your financial stability and propels you closer to your goals. Stay the course, and the rewards will be tangible.

Stay Informed and Educated

Financial landscapes shift constantly, and you must keep pace. Regularly update your financial knowledge to make informed decisions. Here are a few ways to do that:

- Stay Updated: The financial sector often introduces new regulations, products, or tax changes. Stay informed to anticipate how these shifts might impact your budget or financial strategy.

- Subscribe to Reliable Sources: Consider signing up for newsletters or updates from trusted financial platforms. This ensures you receive timely and accurate information on financial market trends or new banking products.

- Attend Workshops: Many community centers, banks, and organizations hold financial literacy workshops. These sessions can give you insights into budgeting techniques, investment strategies, or debt management.

- Read Books: There are numerous well-regarded books on personal finance. These can provide foundational knowledge and deep dives into specific areas of interest.

- Leverage Online Tools: Many online platforms offer free courses, calculators, or simulations to help you better understand financial concepts or scenarios—use them.

- Switch When Beneficial: If you learn about a better financial product, like a savings account with higher interest or a credit card with better rewards, don’t hesitate to switch if it aligns with your goals. Continually evaluate the terms and potential benefits.

Remember, the more informed you are, the better positioned you’ll be to make decisions that align with your financial goals. Being proactive in your financial education means you’re not just reacting to the world but strategically navigating it to your advantage.

Common Budgeting Challenges and Solutions

Creating and maintaining a budget can be daunting. Let’s briefly review common challenges you might face and practical solutions to keep you on track.

Inconsistent Income

Many individuals, especially freelancers, entrepreneurs, or commission-based workers, often face the issue of inconsistent income. Creating a budget is challenging when you’re unsure of your monthly earnings. One effective strategy is to base the budget on the lowest estimated monthly income. You can allocate any extra income towards savings or unexpected expenses.

Impulse Spending

Impulse spending is a common challenge, where unexpected expenses derail a budget. Implementing a 48-hour rule where you think over any unplanned purchase for two days can be helpful. Also, avoiding environments or websites where impulse spending is triggered can mitigate this issue.

Unforeseen Expenses

Unexpected costs like medical emergencies or urgent car repairs can destabilize a well-planned budget. Creating an emergency fund that covers 3-6 months’ worth of living expenses can buffer the impact of unexpected costs.

Setting Unrealistic Goals

Setting unattainable savings or spending goals can lead to frustration and abandonment of the budgeting process. Goals should be SMART—Specific, Measurable, Achievable, Relevant, and Time-bound. Begin with small, attainable goals and gradually increase them as you gain control over your finances.

Lack of Financial Education

Many individuals lack foundational knowledge in managing finances, leading to inefficient budgeting. Seeking educational resources, attending workshops, or consulting with a financial advisor can provide insights and tools to manage finances effectively.

Living in High-Cost Areas

Living in high-cost areas like New York, San Francisco, or London often means that basic needs such as rent, utilities, and groceries can exceed 50% of one’s income. This imbalance poses a significant challenge for individuals trying to adhere to the 50-30-20 budgeting rule. Here, the 50% allocated to needs is often insufficient, leading to a skewed budget. In such scenarios, you can consider the following adjustments:

- Adjusting the 50-30-20 Budgeting Rule: Modify the percentages to suit your specific scenario. For instance, you could allocate a higher percentage to needs, a lower percentage to wants, savings investments, and debt repayment.

- Increasing Income: Seek additional income sources or higher-paying job opportunities to cover high living costs comfortably.

- Cost Reduction: Explore options to reduce living expenses, like shared housing or minimizing utility costs.

Dealing With High Levels of Debt

Individuals with significant debt, especially high-interest debt, often find a substantial portion of their income going toward debt repayment. This situation can hinder the effective implementation of the 50-30-20 rule, as servicing the debt eats into the percentages allocated for needs and wants. If you have a lot of debt, consider implementing the following strategies:

- Debt Avalanche: This strategy involves making minimum payments on all your debts and using any remaining funds to pay the debt with the highest interest rate. List all debts from the highest to the lowest interest rate, maintain minimum payments on all, and focus extra funds on the debt with the highest interest rate. Adopting this strategy allows you to reduce your total interest payments and eliminate your most expensive debts quickly.

- Debt Snowball: This strategy involves paying off the smallest debts first while making minimum payments on larger ones, allowing for psychological wins to motivate continued debt repayment. List debts from smallest to largest amount, focus on paying off the smallest debt while making minimum payments on others. Quick wins in paying off small debts can motivate and build momentum for tackling larger debts.

- Debt Consolidation and Refinancing: This strategy combines several outstanding debts into a single, more manageable loan. By doing this, you simplify your repayment process. Further, refinancing that consolidated loan at a lower interest rate can reduce monthly payments and save you substantial money over the loan’s lifespan.

- Negotiating Interest Rates: Contact lenders to negotiate lower interest rates on your debts, reducing the total interest paid over time. Reducing your total interest payable makes debts more manageable. Prepare a case for why you should have a reduced interest rate (e.g., good payment history, market research on better offers) and contact your lenders to negotiate.

- Increase Income and Allocate to Debts: Find ways to increase income, either through a side hustle, overtime, or a higher-paying job, and dedicate the additional income to debt repayment. Doing this allows you to accelerate debt repayment without compromising your existing budget.

- Seek Professional Help: Consider seeking advice from a debt counselor or financial advisor to create a customized plan to tackle the debt.

Case Study: Sarah’s Journey With the 50-30-20 Budgeting Rule

Meet Sarah. She’s a 28-year-old software engineer living in a mid-sized city. She earns a steady paycheck but struggles to manage her money effectively. She reads about the 50-30-20 budgeting rule and decides to try it. Here’s how Sarah implements and adjusts this budgeting strategy based on her circumstances:

Step 1: Determine After-Tax Income

After accounting for federal and state taxes, Sarah’s monthly salary is $4,000.

Step 2: Apply the 50-30-20 Budgeting Rule

According to the rule:

- 50% ($2,000) is for needs.

- 30% ($1,200) is for wants.

- 20% ($800) is for savings, investments, and debt repayment.

Step 3: Categorize Expenses

Pulling data from an expense-tracking app she uses, Sarah lists her monthly essential expenses:

- Rent: $1,100

- Utilities: $150

- Groceries: $300

- Car payment: $250

- Health insurance: $100

Totaling these, she spends $1,900 on necessities, which is within the $2,000 limit.

For her “wants,” Sarah listed the following expenses:

- Dining out: $400

- Entertainment (movies, concerts): $200

- Shopping: $400

- Gym membership: $100

These non-essentials total $1,100, which is under the $1,200 allocation.

Sarah has a student loan, which she’s paying off at $400 per month. She decides to allocate the remaining $400 towards her savings.

Step 4: Adjustments Based on Circumstances

A few months later, Sarah’s rent increased to $1,200 due to property value appreciation in her area. Her “needs” now total $2,000, precisely 50% of her income. She realizes she has no room for unexpected necessities in the future.

She reviews her “wants” and decides to cut back on shopping, reducing it to $300, saving her an additional $100. She reallocates this amount to her “needs” category to cushion against potential future rent hikes or other unforeseen necessary expenses.

Step 5: Routine Re-evaluation

After a year, Sarah received a 5% raise. Her after-tax income now stands at $4,200. She decides to keep her spending on “needs” and “wants” the same and allocates the entirety of her raise (an extra $200) towards her student loan, accelerating her debt repayment.

Pro Tips Sarah Implemented

Sarah made several intelligent moves along her journey, leveraging the pro tips in this article to enhance her financial management. Here’s how:

- Automation of SIDR: To ensure consistency in her savings, Sarah automated her savings, investments, and debt. Each month, $400 was automatically directed to her student loan and a portion into her savings account. This removed the hassle of manual transfers and reduced the temptation to divert the funds elsewhere.

- Quarterly Assessments: She committed to a quarterly review of her budget. These regular check-ins help her identify and adjust for changes, such as the increase in rent and her pay raise, ensuring her budget remains aligned with her financial reality.

- Utilizing Digital Tools: Sarah uses an expense tracking app to monitor her spending closely. The real-time tracking and alerts from the app helped her stay within her allocations’ boundaries and avoid overspending.

- Self-Education: Sarah subscribed to a few financial wellness newsletters and occasionally listened to personal finance podcasts during her commutes. These resources often shared insights on savings opportunities, investment tips, and more.

Budgeting Challenges Sarah Overcame

No journey is without its bumps and turns. Sarah had her fair share of hurdles, but each presented an opportunity to learn and adapt. Here’s how:

Unexpected Rent Increase

The rent increase was a significant hurdle. Sarah was already close to the 50% threshold for her “needs,” and the hike threatened to push her over the limit.

- Solution: Sarah reassessed her spending, particularly within the “wants” category. By cutting back on shopping expenses, she reallocated funds to cover the increased rent while staying within the budget guidelines.

Impulse Buying

Sarah’s Achilles heel was online shopping, a habit that often enticed her to spend beyond her “wants” budget.

- Mitigation: Sarah instituted a 48-hour rule. Whenever the urge to buy non-essential items online struck, she’d wait 48 hours before purchasing. More often than not, the impulse faded. Additionally, she set up an expense-tracking app to alert her when she nears her allocation, helping to curb impulsive buys.

Raise Management

Sarah got a 5% raise, which was a pleasant surprise. The raise was also a potential pitfall because the extra income could easily be lost to lifestyle inflation, negating the financial benefit.

- Strategy: Instead of inflating her lifestyle, Sarah directed the extra income toward her student loan, a step closer to debt freedom.

A Look Ahead

Within two years, by following and adjusting the 50-30-20 rule based on her circumstances, Sarah managed to pay off a significant portion of her student loan, build a decent emergency fund, and even take a short vacation without debt.

Sarah’s ability to adapt her budget to the evolving circumstances stood out. She didn’t just set and forget her budget; she engaged with it, adapted it, and, in doing so, turned it into a dynamic tool that worked effectively in her favor.

Alternative Budgeting Strategies

While the 50-30-20 rule is a widely recognized method for budgeting, it’s not the only budgeting strategy out there. Let’s briefly examine some alternative budgeting strategies.

Zero-Based Budgeting

Zero-based budgeting allocates every dollar of your income to a specific expense, leaving zero dollars unaccounted for. At the start of each month, you’re essentially “earning” your budget afresh. This budgeting strategy requires you to scrutinize every expense and can be particularly useful for individuals seeking tight control over their finances.

For example, if you earn $4,000 monthly, every single one of those dollars is assigned to an expense, be it for rent, groceries, savings, or entertainment, ensuring there’s no leftover money without a designated purpose.

This budgeting strategy is ideal if you want a detailed oversight of your spending, ensuring that every dollar is put to good use. However, it can be time-consuming as it requires meticulous planning and tracking.

Envelope System

The envelope system is an archaic budgeting strategy that divides cash into different envelopes assigned to various expense categories. You only spend the money allocated to each category, helping to curb overspending. For example, you might allot $200 for dining out and place this amount in an envelope. Once spent, there’s no more dining out for that month.

This budgeting strategy is suitable if you struggle with overspending and need a tangible system to instill discipline. It can, however, be inconvenient and isn’t always practical for online or digital transactions.

The 70-20-10 Budgeting Rule

Under this budgeting strategy, 70% of your income covers living expenses, 20% goes into savings, and the remaining 10% is for debt repayment or additional savings. This strategy can be a viable alternative if your essential expenses consistently exceed 50% of your income.

Which Budgeting Strategy Should You Choose?

Choosing the proper budgeting technique depends on your financial situation, goals, and preferences. Evaluate each method’s structure and demands against your income, expenses, and financial objectives to identify which approach aligns with your lifestyle and goals. Always be prepared to adjust your strategy as your financial circumstances evolve to ensure your budget remains an effective tool that promotes financial stability and growth.

Grab Your Free Budgeting Template Here!

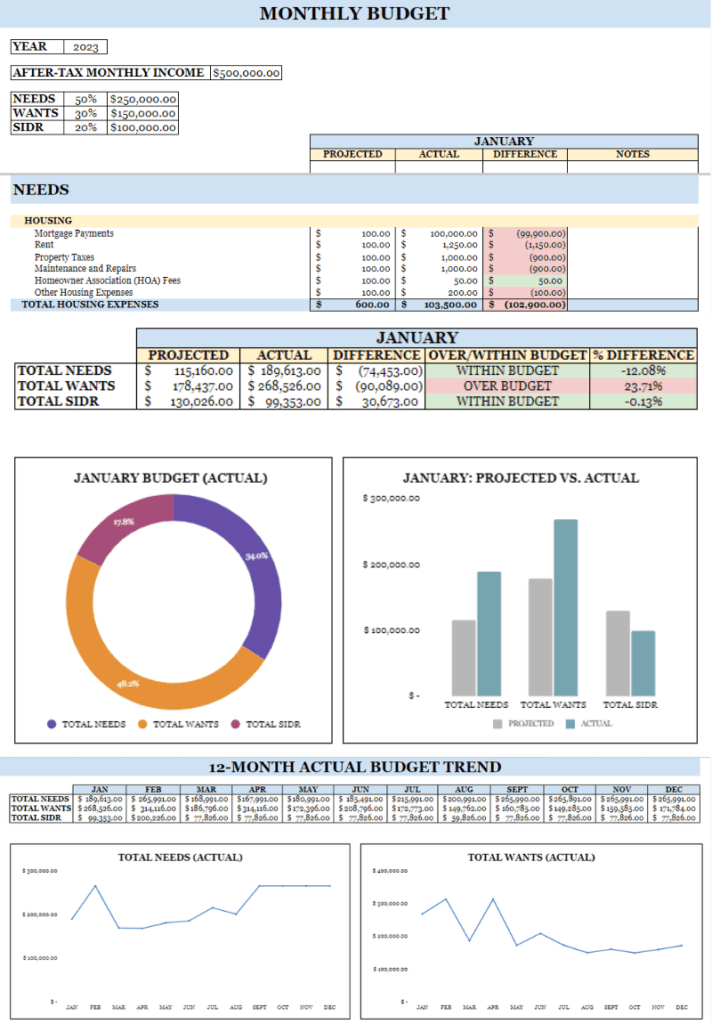

Take control of your finances using our straightforward, free budgeting template. It’s equipped with several categories, easily adjustable to fit your financial situation, and visual dashboards for at-a-glance insights.

No more guesswork—gain a clear view of your financial standing and start making informed decisions to reach your financial goals faster. Your path to a balanced budget and financial clarity is just a click away. Don’t miss out; download it now!

DOWNLOAD: 50-30-20 Budget Template

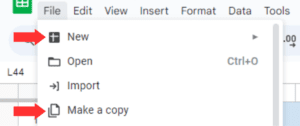

How to Use the Template

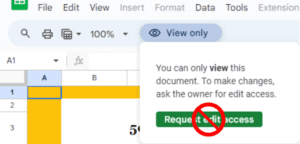

The template is a view-only file and can’t be edited. To use, click on “File” and then select “Make a copy.” This will get you a copy of the template that can be modified.

Don’t request edit access, please.

In Conclusion: Mapping Out Your Financial Journey

Effectively managing your finances boils down to embracing a few core principles: living within your means, prioritizing essential expenses, and steadily building your savings. The 50-30-20 budgeting rule exemplifies these principles, offering a timeless and straightforward approach to budgeting.

Budgeting isn’t about depriving yourself; it’s about making decisions that align with your financial goals. In today’s digital age, with the barrage of marketing messages and the ease of online shopping, the 50-30-20 rule acts as your financial map, ensuring you stay on course.

But as with any personal finance concept, flexibility is vital. Your earning patterns, financial obligations, and goals may necessitate a more personalized budgeting strategy. As a result, it’s perfectly alright to modify the percentages or explore other budgeting strategies to find what works for your current financial situation.

But as with any personal finance concept, flexibility is vital. Your earning patterns, financial obligations, and goals may necessitate a more personalized budgeting strategy. As a result, it’s perfectly alright to modify the percentages or explore other budgeting strategies to find what works for your current financial situation.

Overall, the essence of the 50-30-20 budgeting rule is not about strictly adhering to a particular rule but adopting a structured, disciplined, and informed approach to managing your finances. Always align your spending and saving habits with your short-term and long-term financial objectives.

About the Author

Abolade Akinfenwa is a multi-certified finance professional. He’s certified as a Financial Modeling & Valuation Analyst (FMVA)®, Capital Markets & Securities Analyst (CMSA)®, Commercial Banking & Credit Analyst (CBCA)®, Financial Planning & Wealth Management Professional (FPWM)™, and FinTech Industry Professional (FTIP)™. With over three years of experience as a Financial Writer, Abolade specializes in helping finance professionals build authority and generate qualified leads for their services. Interested in collaborating or seeking insights? Connect with Abolade via LinkedIn or X, or email him.

Sources

At ACDS Publishing, we hold ourselves to the highest standard of accuracy and credibility, ensuring that our readers receive only the most verifiable and substantiated information. To achieve this, we rely on a rigorous approach that involves sourcing information from reliable primary sources, including white papers, government data, original reporting, and expert interviews. By employing these methods, we strive to deliver factual and authoritative content that our readers can confidently trust.

[1] LendingTree. “Average Credit Card Interest Rate in America Today.” Retrieved from https://www.lendingtree.com/credit-cards/average-credit-card-interest-rate-in-america/#:~:text=The%20average%20credit%20card%20interest,of%20credit%20card%20interest%20rates.

Get newsletter updates from Alex

No spam. Just the highest quality ideas that will teach you how to build wealth via the stock market.