Form 10-Q: Definition, Importance, & Components

Form 10-Q is a crucial document for investors. This quarterly report provides a snapshot of a company’s financial performance, offering valuable insights for making informed investment decisions and evaluating the overall health of a business.

This article will delve into the importance of Form 10-Q, its components, deadlines, and consequences of public companies failing to meet the filing requirements. Additionally, we will touch on other essential SEC filings and address some frequently asked questions about Form 10-Q. Let’s dive in.

Table of Content

- What is Form 10-Q?

- Purpose of Form 10-Q

- Why is Form 10-Q Important?

- Key Aspects of Form 10-Q

- Key Sections of Form 10-Q

- Form 10-Q Filing Deadlines

- Failure to Meet Form 10-Q Deadlines

- Components of Form 10-Q

- Other Important SEC Filings

- How Can Investors Use Form 10-Q to Make Investment Decisions?

- Form 10-Q FAQs

- The Bottom Line

What Is Form 10-Q?

Form 10-Q is a mandatory quarterly report filed by publicly traded companies in the United States with the Securities and Exchange Commission (SEC). This form provides an overview of the company’s financial position, including its assets, liabilities, revenues, and expenses, as well as updates on its operations and management during the most recent quarter.

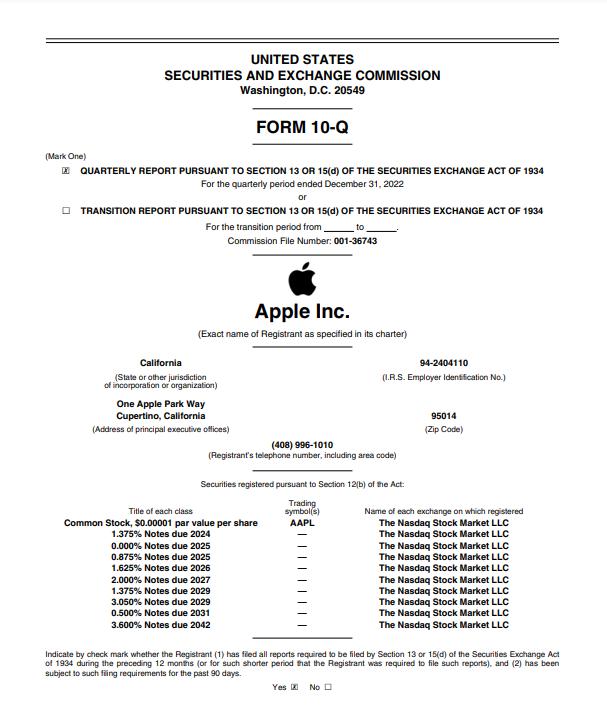

Apple’s 10-K

Purpose of Form 10-Q

The primary purpose of Form 10-Q is to give investors, analysts, and regulators an updated view of a company’s financial performance and business activities during a specific quarter. It enables them to assess the company’s financial health, growth prospects, and risks and compare its performance against competitors and industry benchmarks. As a result, Form 10-Q helps promote transparency, investor confidence, and an efficient market.

Why is Form 10-Q Important?

Form 10-Q is vital for several reasons:

- Transparency: It provides investors an updated view of a company’s financial health and operations, fostering transparency and trust.

- Informed Decision-Making: Investors can use the information in the 10-Q to make informed investment decisions and gauge a company’s performance over time.

- Regulatory Compliance: Filing Form 10-Q helps companies comply with the SEC’s reporting requirements, ensuring they meet the necessary legal standards.

- Benchmarking: Companies can use Form 10-Q to compare their performance against competitors and industry standards, enabling them to strategize for future growth.

Key Aspects of Form 10-Q

- Frequency: Companies must file Form 10-Q for each fiscal year’s first three quarters. The fourth quarter’s financial information is included in the annual report (Form 10-K), which is more comprehensive and requires an audit.

- Timeliness: Form 10-Q must be filed within 40 or 45 days after the end of the quarter, depending on the company’s size and classification by the SEC.

- Contents: Form 10-Q contains unaudited financial statements, management’s discussion and analysis (MD&A), and disclosure controls and procedures. It may also include updates on legal proceedings, risk factors, and other significant events that occurred during the quarter.

- Public Access: Form 10-Q filings are available to the public through the SEC’s EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system, allowing investors to easily access the information and make informed decisions.

Key Sections of Form 10-Q

Financial Statements

- Balance Sheet: This statement illustrates a company’s assets, liabilities, and shareholders’ equity as of the report date, providing insights into its financial stability and solvency.

- Income Statement: This statement reports a company’s revenues, expenses, and net income or loss over the quarter. It highlights the firm’s profitability and helps investors assess its earnings potential.

- Cash Flow Statement: This statement tracks cash inflows and outflows from operating, investing, and financing activities, giving investors a better understanding of the company’s liquidity and cash management.

- Notes to Financial Statements: These provide additional context and explanations for the financial data, including accounting policies, significant estimates, and contingencies.

Management's Discussion & Analysis (MD&A)

MD&A offers a qualitative and quantitative analysis of a company’s performance, as explained by the management. This section covers various aspects, such as:

- Overview of Business: A summary of the company’s operations, products, services, and market conditions.

- Results of Operations: A detailed analysis of the company’s financial results, including revenue and expense trends, segment performance, and factors impacting profitability.

- Financial Condition: An assessment of the company’s liquidity, capital resources, and capital expenditures, helping investors gauge its ability to meet financial obligations.

- Risk Factors: A discussion of potential risks and uncertainties that could materially affect the company’s future performance, including market risks, operational risks, and regulatory risks.

Disclosure Controls & Procedures

- Evaluation of Disclosure Controls: A statement from the company’s CEO and CFO, asserting their responsibility for establishing and maintaining adequate disclosure controls and procedures to ensure the accuracy and timeliness of the financial information reported in Form 10-Q.

- Changes in Internal Control: A description of any changes in the company’s internal control over financial reporting during the most recent fiscal quarter, which could materially affect its controls and procedures.

- Limitations of Controls: An acknowledgment that, despite the company’s efforts to maintain effective internal controls, there is no guarantee that these controls will prevent all errors or fraud.

Form 10-Q Filing Deadlines

Filing deadlines for Form 10-Q depend on the company’s size, as classified by the SEC [1]:

- Large accelerated filers (companies with a public float of $700 million or more): These companies must file their 10-Q within 40 days of the end of the quarter.

- Accelerated filers (companies with a public float of $75 million or more but less than $700 million): These companies must file their 10-Q within 40 days of the end of the quarter.

- Non-accelerated filers (companies with a public float of less than $75 million): These companies must file their 10-Q within 45 days of the end of the quarter.

Failure to Meet Form 10-Q Deadline

Components of Form 10-Q

The main components of Form 10-Q include financial statements, management’s discussion and analysis, and disclosure controls and procedures, as previously mentioned. Other elements may encompass legal proceedings, risk factors, unregistered sales of equity securities, and material modifications to the rights of security holders.

Other Important SEC Filings

Apart from Form 10-Q, other critical filings include:

- Form 10-K: An annual report that provides a comprehensive overview of a company’s financial performance and operations for the entire fiscal year.

- Form 8-K: A report that discloses significant events or changes in a company’s operations, such as mergers, acquisitions, or leadership changes.

- Form DEF 14A (Proxy Statements): These documents contain information about a company’s management, executive compensation, and corporate governance for shareholders to review ahead of annual meetings and voting on key issues.

How Can Investors Use Form 10-Q to Make Investment Decisions?

Investors can use Form 10-Q to make informed investment decisions by analyzing various aspects of a company’s financial performance and operational developments during a specific quarter. Here are some ways investors can use the information provided in Form 10-Q:

- Assess Financial Health: By examining the financial statements, investors can gain insights into a company’s profitability, liquidity, solvency, and cash flow management. They can use these insights to determine whether the company is financially stable and capable of meeting its short and long-term obligations.

- Identify Trends and Performance: The Management’s Discussion and Analysis (MD&A) section provides a comprehensive view of the company’s operations, highlighting trends, risks, and management’s plans for the future. Investors can use this information to evaluate the company’s growth potential, operational efficiency, and ability to adapt to market changes.

- Evaluate Risk Factors: Form 10-Q may include updates on risk factors that could materially affect the company’s future performance. Investors can use this information to assess the potential risks associated with an investment and decide if the potential rewards outweigh those risks.

- Monitor Operational Developments: Form 10-Q may contain updates on significant events, such as mergers, acquisitions, divestitures, legal proceedings, or regulatory actions that occurred during the quarter. Investors can use this information to gauge the potential impact of these events on the company’s financial performance and prospects.

- Compare Companies: Investors can use Form 10-Q filings to compare the performance of different companies within the same industry or sector. By comparing financial ratios, growth rates, and other key metrics, they can identify the best-performing companies and make more informed investment decisions.

- Track Management Performance: Form 10-Q provides insights into management’s decisions and strategies. Investors can use this information to evaluate the effectiveness of a company’s management team and their ability to steer the company toward growth and profitability.

In summary, Form 10-Q provides a wealth of information that investors can use to make well-informed investment decisions. By analyzing financial statements, identifying trends, evaluating risks, and monitoring operational developments, investors can better understand a company’s performance and potential, enabling them to make more informed choices when investing in or trading stocks.

Form 10-Q FAQs

Some frequently asked questions regarding Form 10-Q include:

Is Form 10-Q Audited?

No. Unlike Form 10-K, which requires an external audit, Form 10-Q is not audited. However, the company’s management is responsible for ensuring the accuracy and reliability of the information provided.

Can Form 10-Q Be Amended?

Yes. If a company identifies errors or omissions in a previously filed 10-Q, it can file an amended Form 10-Q (Form 10-Q/A) to correct the information.

How Do I Access a Company's Form 10-Q?

You can access a company’s Form 10-Q filings through the SEC’s EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system, which is available for free on the SEC’s website. Many companies also provide their Form 10-Q filings on their investor relations websites.

The Bottom Line

Form 10-Q is a critical analytical tool for stock market investors, offering essential insights into a company’s financial health and operational performance during a specific quarter.

Understanding the components and significance of this report is vital for making informed investment decisions. By familiarizing yourself with Form 10-Q and other important filings, you will be better equipped to assess investment opportunities, monitor a company’s performance, and make well-informed decisions for your financial future.

Sources

At ACDS Publishing, we hold ourselves to the highest standard of accuracy and credibility, ensuring that our readers receive only the most verifiable and substantiated information. To achieve this, we rely on a rigorous approach that involves sourcing information from reliable primary sources, including white papers, government data, original reporting, and expert interviews. By employing these methods, we strive to deliver factual and authoritative content that our readers can confidently trust.

- U.S. Securities and Exchange Commission. “Form 10-Q”. Retrieved from https://www.investor.gov/introduction-investing/investing-basics/glossary/form-10-q

Get newsletter updates from Alex

No spam. Just the highest quality ideas that will teach you how to build wealth via the stock market.