Form 1040: Definition, Types, & Tips

Filing your taxes can be a daunting task, especially if you don’t know what all the information means and where to find it. The 1040 tax form is the most commonly used form for filing your federal income tax return. Understanding the form is essential in filing your taxes correctly, so let’s break it down!

Table of Content

What Is Form 1040?

Form 1040, the U.S. Individual Tax Return Form, is a comprehensive document for taxpayers to report their annual income, determine tax liability, and fulfill their tax obligations. This essential form not only allows for the calculation and payment of taxes but also enables individuals to claim credits or refunds for eligible expenses such as charitable donations, medical costs, and investment losses.

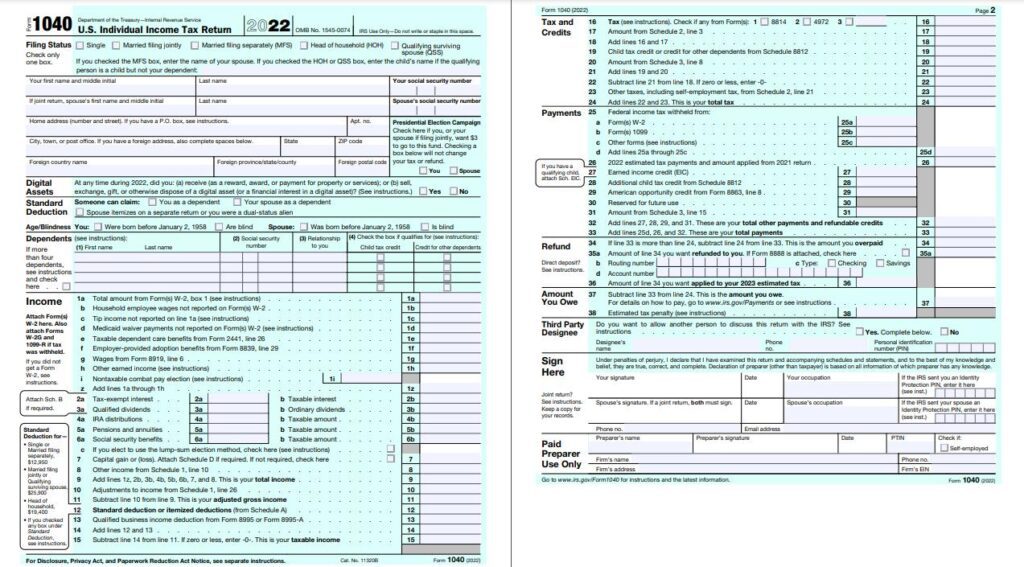

The 1040 form is structured into six distinct sections, which include:

- Personal Information: This section captures essential details about the taxpayer, including their name, address, and Social Security Number.

- Filing Status: Here, taxpayers indicate their filing status (e.g., single, married filing jointly, head of household), which impacts tax rates and deductions.

- Income: This part of the form requires taxpayers to list various sources of income, such as salaries, dividends, and capital gains, to determine their total taxable income.

- Adjustments to Income: In this section, taxpayers can account for specific deductions that lower their taxable income, such as contributions to retirement accounts or student loan interest.

- Taxes: This segment calculates the taxpayer’s total tax liability based on their taxable income and applicable tax rates or credits.

- Refund/Amount You Owe and Other Payments/Refunds: Finally, this section compares the taxpayer’s total tax liability to the amount of tax they have already paid, determining whether they are eligible for a refund or if they owe additional taxes.

Sample of 1040 Tax Return

Types of Form 1040

There are several types of Form 1040, including:

- Form 1040: This is the standard form most taxpayers use to report their income, calculate their tax liability, and pay taxes in one annual filing. [1]

- Form 1040-SR: This is a simplified version of Form 1040 for taxpayers aged 65 or older. It includes larger font sizes and simplified instructions, making it easier for older taxpayers to complete. [2]

- Form 1040-NR: This form is used by nonresident aliens who have income from sources in the U.S. It reports the nonresident alien’s income and deductions, as well as any tax liability owed to the U.S. government. [3]

- Form 1040-SS: This form is used by self-employed individuals who have income from sources in the U.S. Virgin Islands, Guam, American Samoa, or the Commonwealth of the Northern Mariana Islands. It reports their income, deductions, and any tax liability owed to the U.S. government. [4]

- Form 1040-PR: This form is used by taxpayers who are residents of Puerto Rico and have income from sources within Puerto Rico. It reports their income, deductions, and any tax liability owed to the Puerto Rican government. [5]

- Form 1040-X:This form is used to amend a previously filed Form 1040. Taxpayers may use this form to correct errors or omissions on their original tax returns, such as missed deductions or credits. [6]

- Form 1040-NR-EZ: This form is a simplified version of Form 1040-NR for nonresident aliens who have no dependents, no itemized deductions, and who meet other specific requirements. It is a shorter form that is easier to complete for those who qualify.

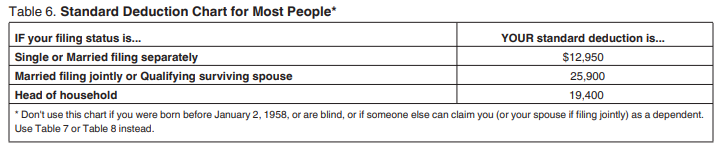

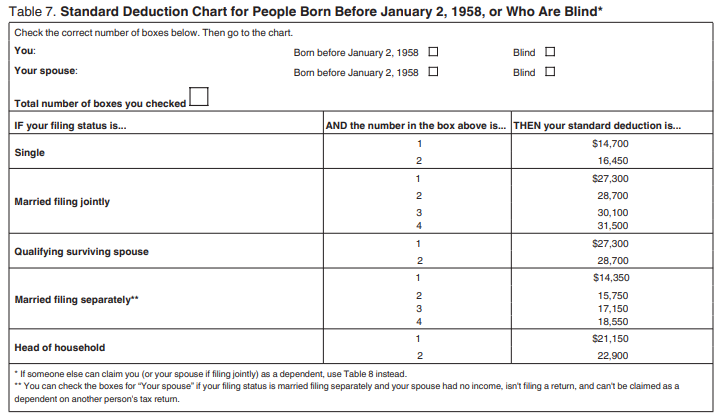

Standard Deductions

Taxpayers can choose to claim either the standard deduction or itemized deductions. The standard deduction is a fixed amount that reduces taxpayers’ taxable income. The standard deduction for the 2022 tax year is $12,950 for single filers and $25,900 for married couples filing jointly. Taxpayers claiming the standard deduction do not need to provide documentation of their expenses. [7]

Source: Internal Revenue Service

Additional Schedules

Depending on their situation, taxpayers may need to fill out additional schedules to report specific types of income or deductions. For example, taxpayers who received income from a partnership, S corporation, or trust must fill out Schedule K-1. Also, taxpayers claiming certain tax credits, such as the Child and Dependent Care Credit, must fill out Schedule 3.

Who Needs to File a Form 1040

Most U.S. citizens and resident aliens must file a tax return if their income exceeds certain thresholds. For the 2022 tax year, single taxpayers under age 65 must file a return if their income is at least $12,950. Married taxpayers filing jointly must file a return if their income is at least $25,900.

How to Complete a 1040 Tax Return

To complete a 1040 tax return, taxpayers should gather all necessary documents, including W-2s and 1099s, and any records of expenses they plan to deduct. They should then enter their personal information, income, deductions, and credits on the appropriate lines of the form. Taxpayers should double-check their calculations before submitting their returns to ensure accuracy.

Tips for Filing Your 1040 Tax Return

Filing a 1040 tax return can seem intimidating, but the following tips can make the process smoother:

- Tip 1:Gather all relevant documents before beginning

- Tip 2: Double-check calculations before submitting

- Tip 3: Be sure to check for any applicable credits or deductions

- Tip 4: Use IRS Free File if applicable

- Tip 5: Keep copies of your filed returns

- Tip 6: File electronically if possible

- Tip 7: Pay any taxes due on time

- Tip 8: Contact an accountant if needed

- Tip 9: Stay organized throughout the process

Form 1040 FAQs

Some frequently asked questions regarding Form 1040 include:

When Is the Deadline to File a 1040 Tax Return?

The deadline to file a 1040 tax return is usually April 15th of each year. However, the deadline may be extended if it falls on a weekend or holiday. In some cases, taxpayers may be able to request an extension to file their return.

What Happens if I Make a Mistake on My 1040 Tax Return?

If a mistake is made on a 1040 tax return, the taxpayer may need to file an amended return to correct the error. Depending on the nature of the mistake, the IRS may assess penalties or interest.

How Can I Get a 1040 Tax Form?

Taxpayers can obtain a 1040 tax form from the IRS website, a local IRS office, or various tax preparation software providers.

Can I Fill Out a 1040 Form Online?

Yes, taxpayers can fill out and file their 1040 tax return online using IRS Free File or commercial tax preparation software.

The Bottom Line

Filing a 1040 tax return may seem overwhelming, but with proper preparation and organization, it can be a manageable task.

Taxpayers should understand the various sections of the form and gather all necessary documents before beginning. Double-checking calculations and taking advantage of available credits and deductions can help reduce tax liability. Filing electronically and paying taxes due on time can also help avoid penalties and interest.

By following these tips and understanding the 1040 tax return form, taxpayers can successfully file their taxes and meet their obligations to the IRS.

Sources

At ACDS Publishing, we hold ourselves to the highest standard of accuracy and credibility, ensuring that our readers receive only the most verifiable and substantiated information. To achieve this, we rely on a rigorous approach that involves sourcing information from reliable primary sources, including white papers, government data, original reporting, and expert interviews. By employing these methods, we strive to deliver factual and authoritative content that our readers can confidently trust.

- Internal Revenue Service. “About Form 1040, U.S. Individual Income Tax Return”. Retrieved from https://www.irs.gov/forms-pubs/about-form-1040

- Internal Revenue Service. “About Form 1040-SR, U.S. Tax Return for Seniors”. Retrieved from https://www.irs.gov/forms-pubs/about-form-1040-sr

- Internal Revenue Service. “About Form 1040-NR, U.S. Nonresident Alien Income Tax Return”. Retrieved from https://www.irs.gov/forms-pubs/about-form-1040-nr

- Internal Revenue Service. “About Form 1040-SS, U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico)”. Retrieved from https://www.irs.gov/forms-pubs/about-form-1040-ss

- Internal Revenue Service. “About Form 1040 (PR), Self-Employment Tax Return – Puerto Rico”. Retrieved from https://www.irs.gov/forms-pubs/about-form-1040-pr

- Internal Revenue Service. “About Form 1040-X, Amended U.S. Individual Income Tax Return”. Retrieved from https://www.irs.gov/forms-pubs/about-form-1040x

- Internal Revenue Service. “Dependents, Standard Deduction, and Filing Information.” Retrieved from https://www.irs.gov/pub/irs-pdf/p501.pdf

Get newsletter updates from Alex

No spam. Just the highest quality ideas that will teach you how to build wealth via the stock market.