Memo #2: New quarter begins with a rally

October 7, 2022

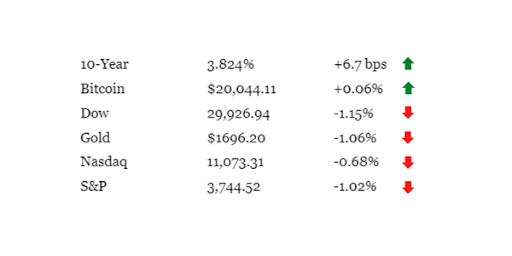

The start of a new quarter is always an exciting time for stock markets, and this one was no different! U.S equities kicked off strongly, with strong rallies in key indexes like the Dow and the S&P. The energy sector continues to outperform most other sectors, and cannabis companies surged higher.

Key Market Data

3 Market-Impacting Discoveries

- Oil prices rose to a three-week high after OPEC+, the group of oil-producing countries, agreed to cut production by 2 million barrels per day. This represents its biggest cut since the world shut down in April 2020 during the early stages of the Covid-19 pandemic. The idea is that slashing production should increase oil prices, which many OPEC countries rely on for revenue. Did it work? Well, Brent crude, the international benchmark, is hovering around $93, representing a three-week high.

- Energy remains 2022’s best sector, with the S&P 500 energy sector (.SPNY) up 44% year-to-date, despite a broader market swoon. Crude oil futures also rose by more than 10% this week alongside gains made in the wider energy sector. If this news is any indication, it doesn’t look like gains in the energy sector will be slowing up any time soon.

- Cannabis companies surged after President Biden signaled a major shift in federal marijuana policy, pardoning all prior federal offenses of simple marijuana possession. Shares of Tilray Brands (TLRY.O) and Canopy Growth Corp (WEED.TO), two well-known marijuana sellers, jumped 22% and 31%, respectively. Also, the ETFMG Alternative Harvest ETF (MJ.P), which includes shares of several cannabis companies, rose almost 20%, while the MSOS cannabis ETF jumped 34%.

Interesting Developments in the Market

The good

- U.S. stocks start the new quarter with a rally as the Dow rose by 2.7%, the S&P 500 by 2.6%, and the Nasdaq Composite by 2.3%. This happened after U.S. equities sustained deep losses for the first nine months of 2022, primarily due to interest-rate increases and monetary tightening.

The bad

- It’s a troublesome time for the semiconductor industry as dwindling demand for PCs after the PC boom of the pandemic, coupled with supply chain issues, creates a perfect storm. The slump in demand for semiconductors is due to soaring cost pressure from interest rate hikes by the Fed to keep rising inflation in check. Semiconductor giant AMD warned of a Q3 revenue shortfall on Thursday, which caused its shares to drop by around 4% in extended trading. Micron also reported mixed earnings for September, and Nvidia issued preliminary earnings reports far below expectations, leaving investors disappointed.

To Do

Watch: Check out this insightful speech from Robert Kiyosaki on why the poor stay poor and the rich keep getting richer.

Read: What Do You Need to Know About Financial Literacy? By Ramsey Solutions.

Listen: Check out this podcast from the Motley Fool on what the future holds for interest rates.

Get newsletter updates from Alex

No spam. Just the highest quality ideas that will teach you how to build wealth via the stock market.