Where to Invest During a Trade War: Where Smart Money Is Going in 2025

Table of Content

2025 has been anything but smooth for investors. With the U.S.–China trade war intensifying, tariffs on key imports have surged to a staggering 145%. The ripple effects are hard to miss: disrupted supply chains, spiking inflation, and unpredictable market swings. If you’re unsure where to park your money right now, you’re not alone.

But here’s the thing: while many investors are pulling back in fear, the smart money isn’t standing still. It’s moving quietly and confidently into assets that have historically thrived in uncertain times: precious metals and defensive sectors.

In this article, you’ll discover how to follow their lead, protect your portfolio, and build financial resilience no matter how rough the economic waters get.

What Happens to Markets During a Trade War?

Trade wars aren’t just political drama playing out in the news; they ripple through every corner of the financial system.

When major economies like the U.S. and China go head-to-head, the fallout goes far beyond the headlines. It affects your portfolio, spending power, and the broader economy’s stability.

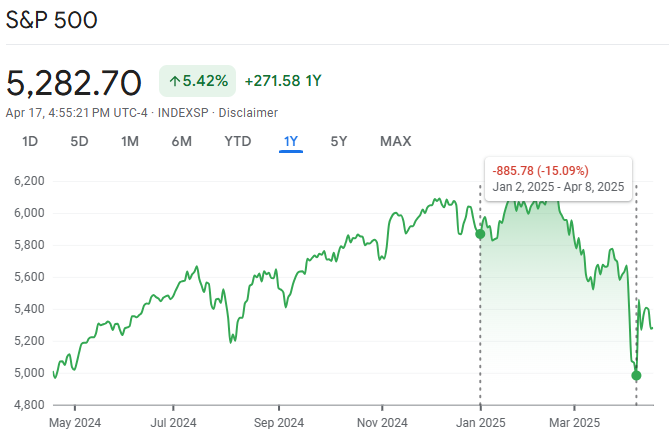

The first sign? Volatility spikes. Markets become jumpy, reacting to every new tariff, policy threat, or diplomatic jab. In early 2025, this played out in real-time. Between January 2 and April 8, the S&P 500 fell by 885 points, a 15% drop that shook investor confidence.

Then there’s inflation. When tariffs increase the cost of importing goods, companies pay more to maintain production. Eventually, those higher costs show up in consumer prices. You notice it at the grocery store, the pump, and online.

Even Fed Chair Jerome Powell cautioned that higher tariffs risk creating “hotter inflation and slower growth,” a dangerous combination that can drag down business and consumer spending.

Currencies also take a hit during a trade war. When global trade confidence falls, so does demand for the dollar.

We’ve already seen the greenback lose ground against the Japanese yen and Swiss franc in 2025 as investors sought safety in more stable currencies.

A weaker dollar may help U.S. exporters, but it also raises the cost of imported goods, adding more fuel to inflation.

And then there’s tech—perhaps the biggest casualty so far. These companies rely heavily on global supply chains and international sales, making them particularly vulnerable to trade restrictions.

Just ask Nvidia. In Q1 2025, its $500 billion semiconductor fab project ran into fresh export curbs, specifically targeting water-intensive chip materials.

The result? A $5.5 billion charge, nearly $10 billion in lost potential revenue, and a 4% drop in the NASDAQ in a single day.

As this uncertainty unfolds, capital starts shifting. Investors begin to pull back from risky assets and seek safer ground. For instance, gold—a historical hedge against inflation and market uncertainty—recently surged past $3,300 an ounce, and defensive stocks are attracting attention due to their stability and consistent returns.

As this uncertainty unfolds, capital starts shifting. Investors begin to pull back from risky assets and seek safer ground. For instance, gold—a historical hedge against inflation and market uncertainty—recently surged past $3,300 an ounce, and defensive stocks are attracting attention due to their stability and consistent returns.

None of these moves are accidental. They’re calculated shifts by investors who understand the playbook: when uncertainty rises, protection beats speculation.

The takeaway? Trade wars shake financial markets from every direction. If your portfolio isn’t positioned defensively, you could be caught off guard when the next headline hits.

The good news? You don’t have to be. In the next section, we’ll break down exactly where smart money is going and how you can follow its lead.

Why Precious Metals Are Attracting Smart Money in 2025

When uncertainty takes over the market, one rule tends to guide smart investors: go where the money stays safe. That’s exactly why capital is flowing into precious metals in 2025.

In an environment shaped by rising inflation, trade tensions, and a shaky U.S. dollar, metals like gold, silver, platinum, and palladium are doing more than just holding their ground—they’re gaining serious momentum.

Gold Is a Timeless Safe Haven

Let’s start with the headliner. Gold is the asset investors flock to when everything else feels unstable. And right now, it’s doing exactly what it’s known for: protecting portfolios.

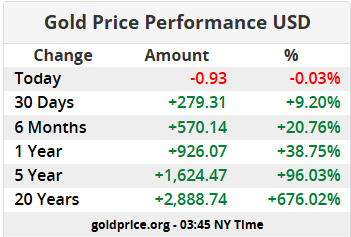

With the U.S. dollar weakening and inflation running hot, gold has surged past $3,300 per ounce, building on a steady upward trend that didn’t start this year.

Just look at the numbers. Over the past 12 months, gold has jumped $926, nearly a 39% increase. In the last six months alone, it’s up over 20%. Stretch that timeline back five years, and the metal has nearly doubled in value. Over the past two decades, it’s delivered an astounding 676% return.

What sets gold apart is that it doesn’t rely on earnings seasons, supply chains, or interest rate policy. It thrives on macro uncertainty like inflation, currency depreciation, or geopolitical tensions, all of which are front and center in 2025. During the 2008 financial crisis, the COVID-19 pandemic in 2020, and now amid the 2025 trade war, gold hasn’t just survived—it’s outperformed.

Silver, Platinum, and Palladium are Underrated Allies

But gold isn’t the only metal catching smart money’s attention. Its lesser-known counterparts (silver, platinum, and palladium) are pulling double duty as both safe havens and engines of industrial growth.

Silver, for example, is essential to fast-growing industries like solar energy, EVs, and 5G infrastructure. With global EV sales projected to hit 17 million units in 2025 and massive government investments into solar tech, silver isn’t just riding the fear trade; it’s riding an innovation wave. Industrial demand gives silver more volatility than gold but also a greater upside when economies rebound.

Then there’s platinum and palladium. While they’re more niche, they’re no less important. Platinum is a key player in hydrogen fuel cells, with adoption ramping up in markets like Japan and Europe. Conversely, Palladium is critical for catalytic converters, helping gas-powered vehicles meet stricter emissions standards, especially in China and the EU.

To sum it up, precious metals are attracting smart money in 2025 because they’re safe and strategic assets. So, if you haven’t already carved out a space for them in your portfolio, now’s the time to reconsider.

How to Invest in Precious Metals

You don’t need to be a vault-owning billionaire to invest in precious metals. Today, plenty of practical options make it easy to gain exposure—no pickaxe required.

Let’s start with the most traditional route: physical metals. Buying gold or silver coins like American Gold Eagles or Canadian Silver Maple Leafs gives you direct ownership. These are ideal if you value long-term security and want a hedge you can literally hold. Just keep in mind that physical metals need to be stored safely, often in a bank vault or home safe, and they can be harder to sell quickly in a pinch.

If you want something more liquid and hassle-free, look into ETFs (Exchange-Traded Funds). These are perfect for hands-off investors. For example, GLD tracks the price of gold, SLV covers silver, and PPLT gives you exposure to platinum. You get all the upside without worrying about storage or security.

Mining stocks are another route for those seeking bigger gains and willing to take on more risk. Companies like Newmont Corporation, Barrick Gold, and First Majestic Silver can outperform when metal prices rise. If you prefer diversification, mining ETFs like GDX (gold miners) or SIL (silver miners) spread the risk across multiple companies.

Whether you’re cautious or aggressive, there’s a metal investment strategy that fits your style.

Why Defensive Stocks Attract Smart Money During a Trade War

When global markets are rattled by uncertainty, especially during a trade war, smart money doesn’t chase hype. It seeks stability. That’s exactly why investors often pivot toward defensive sectors, the quiet performers that hold their ground while others stumble.

Unlike sectors like tech or industrials, which are heavily reliant on global supply chains and international demand, defensive sectors focus on goods and services people use every day, regardless of how the economy is doing.

That kind of consistent demand makes these sectors especially appealing when tariffs rise, sentiment drops, and volatility spikes.

Take healthcare, for example. No one puts off filling prescriptions or visiting the doctor because tariffs are in the news. Companies like UnitedHealth Group and Pfizer continue to generate strong earnings and pay reliable dividends, even during downturns. And that’s because their business models are rooted in necessity, not discretionary spending.

Utilities are another investor favorite during turbulent times. Electricity, water, and gas are non-negotiables. Firms like NextEra Energy and Duke Energy operate under regulated frameworks that provide predictable cash flow. Plus, many have long-term contracts, shielding them from short-term economic disruptions and trade policy shifts.

Then there’s the consumer staples sector, which produces everyday products like toothpaste, cleaning supplies, and groceries.

Giants like Procter & Gamble, Coca-Cola, and Colgate-Palmolive are household names that continue to post steady sales regardless of inflation, interest rates, or trade restrictions.

Since many of these companies focus on domestic production and distribution, they’re less exposed to the rising costs and delays tied to international trade barriers.

That local focus is a key advantage. During a trade war, companies operating primarily within national borders face fewer disruptions from shipping delays, tariffs on imported components, or retaliatory taxes.

For example, CVS Health sources and sells largely within the U.S., which helps it withstand global economic headwinds.

And beyond product demand, there’s a structural safety net: many companies in these sectors benefit from government regulation and contracts.

Utility providers often have guaranteed rate structures, while healthcare and defense contractors frequently operate under multi-year agreements that provide cash flow even when broader markets pull back.

Put simply, defensive sectors offer built-in resilience. They may not deliver flashy returns, but they offer something more valuable: consistency, protection, and peace of mind in times of geopolitical stress and market instability.

That’s exactly why smart money flows here when trade tensions rise. And if you’re looking to shield your portfolio, it might be time you followed suit.

How to Invest in Defensive Sectors

Investing in defensive sectors is a smart move if you want to protect your portfolio during turbulent times.

One of the simplest ways to get started is by using sector-specific ETFs. These offer instant diversification and are easy to trade, like individual stocks.

For example, XLV gives you exposure to major healthcare companies like Pfizer and UnitedHealth Group. XLP focuses on consumer staples, including giants like Coca-Cola and Procter & Gamble, while XLU targets utility providers such as Duke Energy and NextEra Energy.

Prefer a more hands-on approach? You can invest directly in individual blue-chip stocks known for their reliability and dividends. Companies like Colgate-Palmolive, Johnson & Johnson, and CVS Health are long-time favorites among income-focused investors.

Your goal here isn’t to chase big gains. Your goal is to invest in assets that can deliver steady returns and help offset losses elsewhere when the market gets rocky.

Defensive stocks may not be flashy, but they do what matters most in times of uncertainty: they hold their ground.

How to Manage Risk During a Trade War

Navigating a trade war as an investor means thinking strategically, not emotionally. Markets can swing wildly, and headlines can trigger panic, but with the right approach, you can stay protected and find opportunities.

Here are five risk management tips to help you stay resilient:

- Rebalance Away from Vulnerable Sectors: Start by reviewing your exposure to sectors that rely heavily on global trade, like tech, industrials, and consumer discretionary. These sectors are often first to feel the pressure when tariffs hit. Shift a portion of your holdings into more resilient areas like healthcare, utilities, and consumer staples.

- Hedge Against Inflation and Currency Risk: Trade wars can weaken the dollar and increase the prices of imported goods. To stay ahead of inflation, consider investing in precious metals like gold or silver or Treasury Inflation-Protected Securities (TIPS), which adjust with inflation.

- Diversify Internationally:While global tension is high, not all regions are equally affected. Look for international ETFs focusing on countries less tied to the trade conflict.

- Keep Cash on Hand: Holding some cash or short-term bonds gives you flexibility. If the market dips, you’ll be ready to take advantage of undervalued opportunities without having to sell long-term investments at a loss.

- Focus on Long-Term Fundamentals: Stay informed, but don’t get whiplash from daily headlines. Stick to quality companies with strong balance sheets and proven earnings. They’re more likely to weather any storm.

When in doubt, prioritize stability over speculation. Your portfolio will thank you.

Final Thoughts

In uncertain times, investing isn’t about swinging for the fences. It’s about staying grounded, protecting your capital, and planting the seeds for smart growth.

This trade war is your reminder that the market can turn on a dime. But instead of reacting out of fear, you can act with strategy. You can pivot into assets with real-world value and a history of weathering storms, just like the smart money is doing.

So take a moment. Audit your portfolio. Trim what’s not working. Reinforce what is.

Because when the dust settles, the investors who stay resilient will come out ahead.

And if the pros are already there, maybe it’s time you joined them.

About the Author

Abolade Akinfenwa is a multi-certified finance professional. He’s certified as a Financial Modeling & Valuation Analyst (FMVA)®, Capital Markets & Securities Analyst (CMSA)®, Commercial Banking & Credit Analyst (CBCA)®, Financial Planning & Wealth Management Professional (FPWM)™, and FinTech Industry Professional (FTIP)™. With over five years of experience as a content marketer, Abolade specializes in helping finance professionals build authority and generate qualified leads for their services. Interested in collaborating or seeking insights? Connect with Abolade via LinkedIn or X, or email him.

Sources

At ACDS Publishing, we hold ourselves to the highest standard of accuracy and credibility, ensuring that our readers receive only the most verifiable and substantiated information. To achieve this, we rely on a rigorous approach that involves sourcing information from reliable primary sources, including white papers, government data, original reporting, and expert interviews. By employing these methods, we strive to deliver factual and authoritative content that our readers can confidently trust.

Get newsletter updates from Alex

No spam. Just the highest quality ideas that will teach you how to build wealth via the stock market.