Timeless Market Wisdom: Best Investment and Trading Advice from Warren Buffett, Peter Lynch, Jesse Livermore, Michael Burry, and Paul Tudor Jones

Table of Content

What if you could sit down with the greatest minds in investing and hear their best trading and investment advice?

This article does the next best thing.

In it, we’ve distilled timeless lessons from five of the most successful and insightful investors and traders in history, each with a unique style, philosophy, and track record of outperforming the market.

Whether you’re a beginner looking to establish a solid foundation or an experienced trader seeking to refine your approach, these principles have withstood the test of time and market cycles.

Before we dive into each investor’s philosophy, here’s a quick look at who you’ll learn from:

- Warren Buffett, the king of value investing;

- Peter Lynch, the champion of practical curiosity;

- Jesse Livermore, the trader’s trader;

- Michael Burry, the contrarian genius; and

- Paul Tudor Jones, the master of risk management.

Each offers distinct lessons that can enhance your investment mindset, regardless of your experience level.

Let’s dive into the legendary wisdom that continues to shape smart investing today.

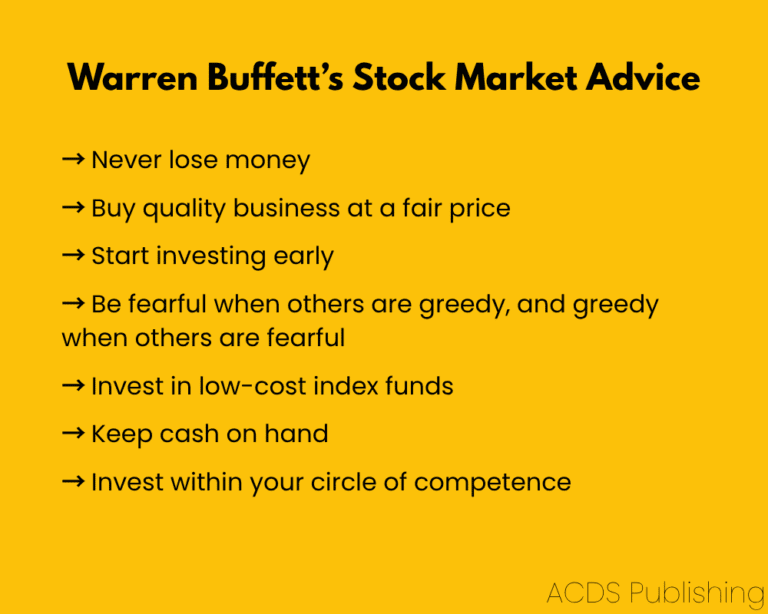

Warren Buffett’s Stock Market Advice

Warren Buffett, often referred to as the “Oracle of Omaha,” is one of the most successful and admired investors of all time.

With a fortune built through long-term investing and a disciplined value-based strategy, Buffett turned Berkshire Hathaway from a struggling textile mill into a multi-billion-dollar holding company [1].

His down-to-earth wisdom, timeless principles, and clear thinking have inspired generations of investors.

However, what sets him apart isn’t just his wealth but the clarity and consistency of his philosophy.

If you want to learn how to build wealth the Buffett way, it starts with understanding the principles he lives by and why they work.

Never lose money

Buffett’s first rule of investing is to avoid losing money. His second rule is never to forget the first [2].

While all investments carry some risk, your job is to avoid unnecessary or permanent losses.

That means staying away from hype-driven stocks, overleveraged companies, and industries you don’t understand.

Instead, focus on businesses with predictable cash flows, strong fundamentals, and a margin of safety in price.

Remember, recovering from a major loss takes far more effort than avoiding it in the first place.

Continually assess the downside first, as successful investing is about preservation before profit.

Buy quality business at a fair price

According to Buffett, it’s far better to buy an excellent business at a fair price than a fair business at an excellent price [3].

A quality business has consistent earnings, high return on equity, low debt, pricing power, and a clear growth path. Buying such a company at a fair valuation reduces risk and increases long-term upside.

The key is understanding what the business is worth and waiting for a price that gives you a margin of safety.

Overpaying, even for a great company, reduces your potential returns. However, buying quality at the right price sets you up to win.

Invest in companies with a durable competitive advantage

Buffett seeks companies with an economic “moat,” which is a sustainable competitive advantage that shields profits from competitors.

This could be a dominant brand (like Coca-Cola), cost leadership (like Walmart), network effects (like Visa), or proprietary assets (like patents or trade secrets).

A strong moat allows a company to maintain pricing power, defend market share, and generate high returns on capital over time.

Buffett famously invested in Coca-Cola in the late 1980s [4], buying when the brand was strong but undervalued.

Over the decades, that one investment returned billions, largely because Coca-Cola’s moat (global brand recognition and distribution) stayed intact through recessions, wars, and changing trends.

Before investing, always analyze the source of the company’s advantage and assess how difficult it would be for a competitor to replicate it.

The harder it is to copy a company’s moat, the more likely it is to deliver strong, compounding returns over time.

Start investing early

Buffett often says compounding is like rolling a snowball: the longer the hill, the bigger it gets [5].

Starting early gives your investments more cycles to grow exponentially, even with modest returns.

For example, investing $100 per month from age 20 to 60 at an 8% annual return yields over $300,000. Waiting just 10 years cut that nearly in half.

You don’t need large sums or perfect timing; you need time.

Begin with what you can, automate your contributions, and let time and consistency do the heavy lifting.

In investing, starting early beats starting big.

Be fearful when others are greedy and greedy when others are fearful

This advice is one of Buffett’s most famous quotes [6]. He recommends you think independently and not follow the crowd.

Markets often swing between extremes of euphoria and panic, leading to mispriced assets.

When greed dominates, stocks tend to be overvalued, and risk is high.

However, when fear grips the market, quality companies often trade at a significant discount to their intrinsic value. That’s when disciplined investors can buy strong businesses at a discount.

Following the crowd leads to average results; thinking independently is how you spot real opportunities and outperform the market.

Invest in low-cost index funds

Buffett recommends low-cost index funds, especially for those who lack the time or expertise to select individual stocks.

An index fund is a type of investment fund that passively tracks the performance of a specific market index by holding the same securities in the same proportions.

For example, an S&P 500 index fund spreads your money across America’s top companies, offering built-in diversification and market-matching returns.

Index investing eliminates emotion and guesswork, making it a reliable and long-term strategy for building wealth.

Buffett even instructed that 90% of his estate be invested in index funds [7], providing a powerful endorsement of their long-term reliability.

Keep cash on hand

Buffett views cash not just as a safety net but as strategic ammunition one can deploy when opportunity comes knocking.

Holding cash means you never have to sell investments at a loss to cover emergencies. It also puts you in a rare position of strength when others are scrambling for liquidity.

In investing, readiness is often your greatest edge.

Invest within your circle of competence

A circle of competence refers to the range of industries, businesses, or subjects that you understand well enough to make informed and confident decisions.

When you operate within this zone, your judgment improves, risks are clearer, and decisions are more rational. Mistakes often come from overreaching into areas you don’t fully grasp.

The size of your circle doesn’t matter; knowing its boundaries does.

In Buffett’s words, “What an investor needs is the ability to evaluate selected businesses correctly. You don’t have to be an expert on everything. [8]”

While Warren Buffett preaches patience, discipline, and buying wonderful businesses at fair prices, Peter Lynch brings a different perspective that combines curiosity, everyday observation, and a tireless hunt for underappreciated growth.

Let’s turn to the lessons from a man who believed the best investing edge might come from your local grocery store aisle.

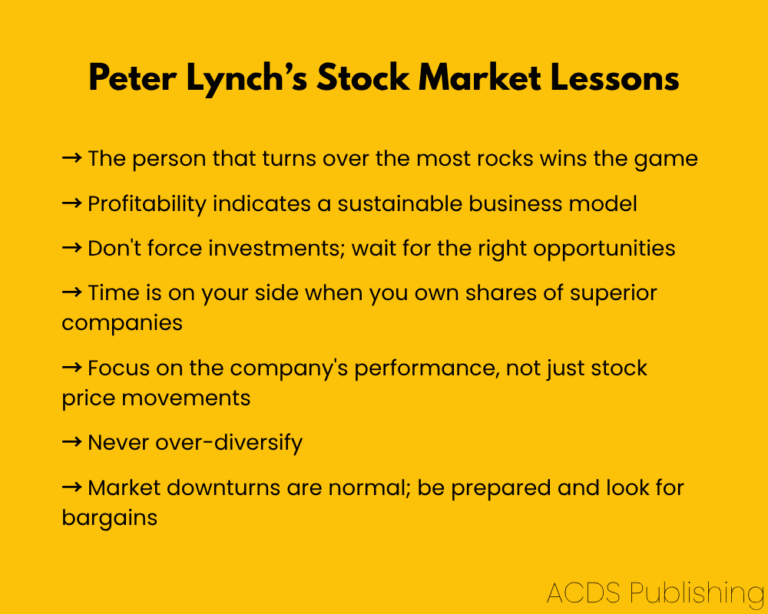

Peter Lynch’s Stock Market Lessons

Few investors have left a mark on Wall Street quite like Peter Lynch.

As manager of Fidelity’s Magellan Fund from 1977 to 1990, he delivered an astonishing average annual return of 29%, growing the fund’s assets from $18 million to over $14 billion.

However, what truly sets Lynch apart isn’t just his track record but his philosophy.

He believed that everyday investors can beat the pros by staying curious, doing their homework, and investing in what they know.

In the section that follows, you’ll explore some of his most practical, timeless advice to help you think smarter and invest with confidence.

The person that turns over the most rocks wins the game

Lynch believes that diligent, everyday research gives you a real advantage [9].

The more businesses you investigate—especially ones you encounter through work, shopping, or hobbies—the greater your chances of finding undervalued opportunities before Wall Street does.

Analyze their financials, growth potential, and industry trends to gain a comprehensive understanding. Look for companies with strong fundamentals, a clear competitive edge, and consistent profitability.

Lynch’s message is clear: successful investing is about doing the legwork, asking the right questions, and being curious enough to dig deeper than everyone else.

That’s how you uncover the winners early.

Profitability indicates a sustainable business model

Lynch cautions against betting on companies with big ideas but no profits.

A profitable business has already passed key tests: it can generate revenue, manage costs, and deliver real value to customers.

Profitability demonstrates that the company’s model works in the real world, not just on a pitch deck. It also means the business is better positioned to reinvest in growth, weather downturns, and reward shareholders.

Lynch warns against betting on stocks that promise future success but bleed cash because if the profits never come, neither will your returns.

Instead, focus on companies with a proven track record of making money. That’s where long-term winners are usually found.

Don't force investments; wait for the right opportunities

One of Lynch’s most underrated tips is about patience [10].

Sitting on cash isn’t a waste; it’s a strategic move.

Many investors lose money by jumping into overhyped or misunderstood stocks in an attempt to stay active.

Great investments aren’t found every day, and forcing trades often leads to regret.

By staying patient and disciplined, you give yourself the space to strike when the odds are truly in your favor, and that’s when real gains are made.

Time is on your side when you own shares of superior companies

Lynch believed great businesses get better over time.

If you’re invested in one, let time do the heavy lifting.

Don’t worry if the stock doesn’t move much in the first few months.

If the company continues to grow its earnings and expand its market, its stock price will eventually reflect this growth.

In the stock market, duration often matters more than timing.

Focus on the company's performance, not just stock price movements

Stocks are not lottery tickets; they represent real businesses.

Watching the price alone tells you nothing about value.

Instead, track the company’s fundamentals: revenue trends, profit margins, product development, customer growth, and management effectiveness.

A rising stock with weak fundamentals is a red flag; a stagnant stock with improving business metrics could be a bargain.

Market prices can be irrational in the short term, but over time, they tend to align with business performance.

Tune out the noise and focus on what truly drives long-term returns: how well the company is actually doing.

Never over-diversify

Peter Lynch warns that over-diversification can turn a focused portfolio into a cluttered mess.

While spreading risk is important, owning too many stocks weakens your ability to monitor them and blurs your conviction.

Lynch suggests focusing on 5 to 12 strong companies you’ve researched thoroughly [11].

Maintaining a small portfolio allows you to act decisively, stay informed, and benefit fully when those companies perform well.

In investing, depth of knowledge often beats breadth of holdings.

You’re better off thoroughly understanding a few exceptional businesses than owning dozens that you can’t fully monitor.

Market downturns are normal; be prepared and look for bargains

Lynch urges you to expect and embrace market declines.

Corrections and bear markets are not crises but buying opportunities for disciplined investors.

Panic selling can drag down even strong companies, offering rare opportunities to acquire quality stocks at a discount [12].

Lynch notes that many of his best investments came from buying during market downturns.

The key is preparation: keep a watchlist, know your companies, and hold cash for moments when the market overreacts.

Use downturns to upgrade your portfolio, not abandon it.

If Lynch encouraged investors to trust what they see in daily life, Jesse Livermore warned that emotional bias could just as easily lead you astray.

One believed in intuition sharpened by research; the other in strict discipline enforced by price action.

Both were right, depending on who you are.

In the next section, you’ll discover how Livermore turned trading into a high-stakes game of patterns, probabilities, and self-mastery.

Jesse Livermore’s Stock Market Tips

Jesse Livermore was one of the most legendary traders in Wall Street history.

Known as the “Boy Plunger,” he famously shorted the market during the Panic of 1907 and the 1929 crash, reportedly earning over $100 million at the height of the Great Depression.

But beyond his dramatic wins and losses, Livermore left behind timeless principles of trading psychology, risk management, and market behavior.

What follows isn’t just trading advice; it’s battle-tested wisdom from a man who lived and breathed the markets.

Markets are never wrong; opinions often are

Livermore warned against confusing conviction with correctness.

No matter how logical your thesis sounds, if the market moves the other way, it’s your opinion, not the market, that is flawed [13].

Price action reflects the collective intelligence and emotions of millions and, therefore, outweighs any single viewpoint.

Fighting it out of ego leads to ruin.

Successful traders adjust, not insist.

Livermore’s edge came from observing what is, not what should be. He trusted price action over personal bias.

If price action disagrees with your opinion, revise your view, not your stop loss.

Only enter a trade after the action of the market confirms your opinion

Livermore cautioned against jumping the gun based on forecasts or gut feelings.

He insisted that price movement must validate your ideas [14]. If a breakout is coming, let the breakout happen first.

Acting without confirmation turns trading into a form of gambling. Livermore believed patience was your first layer of risk management.

The market rewards timing, not guessing.

When price action lines up with your expectation, that’s when probability—and Livermore—are on your side.

Human emotion is the average trader’s worst enemy

Livermore was brutally honest about human weakness in the market [15].

Most traders lose not because the market is against them but because they sabotage themselves by hesitating on entries, holding losers too long, or chasing trends out of greed.

In the market, you’re not just trading stocks; you’re trading against your own biases, impatience, and impulses.

If you’re not aware of how your emotions can sabotage you, they will.

Livermore’s message is clear: if you can’t control your impulses, the market will control you—and not kindly.

First, conquer yourself. Then, you’ll stand a chance at conquering the market.

Let winners run, cut losers fast

Livermore understood that hope is not a strategy, especially when you’re losing.

Holding onto losers, waiting for them to “come back,” ties up capital and clouds judgment.

Conversely, profitable trades often indicate you’re aligned with the trend, and that’s where big gains come from.

Livermore saw each trade as a test. If it moved quickly in his favor, it was valid. If not, he exited without emotion [16].

Chopping winners short and clinging to losers is how most traders fail.

Don’t be like most traders.

Go long when stocks reach a new high. Sell short when they reach a new low

Most people fear buying highs and shorting lows, but Livermore embraced momentum.

When a stock breaks into new territory, it often signals strength or weakness that can persist.

New highs often reflect institutional buying and strong demand. In contrast, new lows may signal broader structural weakness.

Instead of trying to catch tops or bottoms, he rode established trends, entering only when price confirmed strength or breakdown.

Doing so kept him aligned with the dominant market force, not guessing against it.

Livermore’s advice: don’t argue with strength or weakness; ride it [17].

Trends tend to persist longer than most expect, and that’s where the real money is made.

Livermore navigated markets with instinct and momentum; Michael Burry, on the other hand, forged his success with deep data dives, contrarian logic, and an almost obsessive focus on value.

From trading psychology to forensic analysis, Burry’s approach brings a modern twist to timeless investing principles.

Coming up, you’ll learn how Burry’s contrarian mindset and focus on downside protection made him one of the most successful investors of our time.

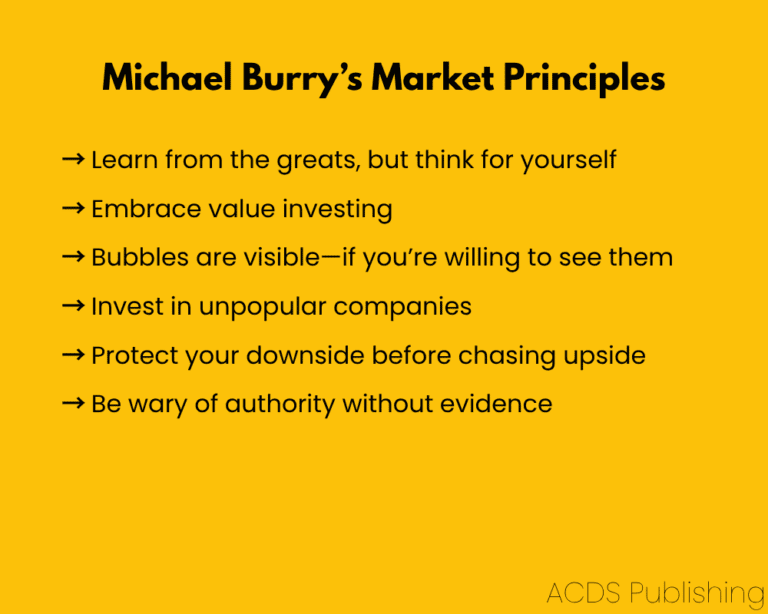

Michael Burry’s Market Principles

Before the world knew him as the eccentric genius from The Big Short, Michael Burry was a quiet, data-obsessed investor running a small hedge fund out of California.

Armed with deep research, strong convictions, and a medical background, he famously bet against the U.S. housing market and won big when the 2008 crash occurred.

His foresight earned him both millions and infamy.

But Burry’s brilliance goes far beyond that one trade.

His investment philosophy is a masterclass in independent thinking, risk management, and value investing.

The following are some of his most powerful principles, along with guidance on how to apply them.

Livermore understood that hope is not a strategy, especially when you’re losing.

Learn from the greats, but think for yourself

Just because someone has a proven track record doesn’t mean their path is the same as yours.

Michael Burry urges you to study legendary investors not to mimic them but to understand how they think.

He points out that even Buffett, though deeply influenced by Graham, eventually developed his investing style [18].

Burry’s key message: use their principles as a foundation, but build your conviction through research, critical thinking, and the courage to act differently when the data demands it.

In a market full of followers, your greatest edge is the ability to think independently and stick to your thesis, even when it’s unpopular.

Learn from the greats, but think for yourself

Michael Burry advocates for value investing as the most rational approach to achieving long-term success in the stock market.

He looks for companies trading below their intrinsic value, often due to temporary issues or market neglect, and buys them.

Too many investors chase hype, only to be left holding the bag.

Burry avoided that fate by sticking to boring but underpriced companies, such as GameStop, which he bought before the meme-stock frenzy.

His value lens helped him identify it as fundamentally undervalued when few were paying attention, and he made around $100 million when he sold his position [19].

Value investing is not about predicting the next big thing; it’s about buying $1 for 50 cents and waiting patiently.

You don’t need to catch every hot stock. You simply need to acquire good assets at favorable prices and let time do the heavy lifting.

Bubbles are visible—if you’re willing to see them

Michael Burry argues that bubbles don’t require hindsight.

They reveal themselves through patterns: rapid credit expansion, euphoric sentiment, inflated valuations, and blind faith in perpetual growth.

In 2007, he spotted the housing bubble by analyzing mortgage data that others had ignored [20].

He believes the clues are always there, but few have the discipline to dig into the data and the courage to stand apart from the crowd.

According to Burry, spotting bubbles isn’t about genius; it’s about skepticism, independent research, and the willingness to act when everyone else is convinced “this time is different.”

Invest in unpopular companies

The crowd usually flocks to what’s shiny, overhyped, and comfortable. But Burry advises you to look where others aren’t.

He believes the market often misprices companies due to negative sentiment, temporary setbacks, or lack of media coverage.

These overlooked “roadkill stocks,” as he calls them, may have strong fundamentals hidden beneath short-term noise [21].

Burry made early investments in such names, betting on mean reversion and fundamental recovery and making a killing.

While the crowd chases hype, your edge lies in doing the work to uncover companies trading below their true worth.

If you can remain unemotional and patient, investing in the unpopular can yield some of the market’s most asymmetric opportunities.

Protect your downside before chasing the upside

Before you focus on how much money you could make, ask yourself how much you could lose.

Burry’s philosophy centers on capital preservation [22].

He believes minimizing downside risk is essential because losses hurt more than equivalent gains help. For instance, a 50% loss requires a 100% gain to break even.

Burry sees capital preservation not as a caution but as a strategy.

The fewer drawdowns you suffer, the more capital you have to compound.

In his view, defense wins championships in investing.

Be wary of authority without evidence

Michael Burry warns that many so-called experts rely on credentials rather than critical thinking.

He believes that deference to authority can blind investors to risk, just as it did before the 2008 crash when top analysts dismissed the housing bubble.

Challenge consensus opinions, demand data, and verify claims with independent research.

Trust facts over fame. Just because someone is on TV or runs a major fund doesn’t mean they’re right.

In markets, groupthink is dangerous.

Your edge comes from doing the hard work others skip and having the conviction to act when the evidence says they’re wrong.

While Burry is known for patient, conviction-driven investing based on raw fundamentals, Paul Tudor Jones built his fortune by anticipating macro turning points and managing risk with military precision.

His philosophy reminds us that in trading, survival often comes before success.

To wrap up, you’ll explore how Jones built his legacy by combining bold forecasts with strict risk management and why his principles are essential for anyone looking to trade with confidence and clarity.

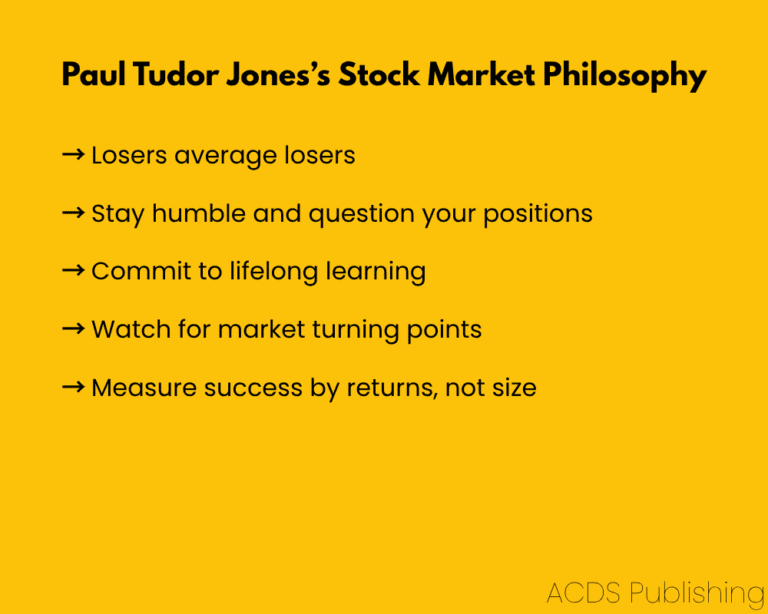

Paul Tudor Jones’s Stock Market Philosophy

Paul Tudor Jones is one of the most legendary hedge fund managers of our time, best known for predicting and profiting from the 1987 stock market crash.

Founder of Tudor Investment Corporation, Jones built his reputation on bold macro calls, disciplined risk management, and an uncanny ability to spot major market turning points.

Jones is a fierce advocate for risk management, humility, and continuous learning.

If you’re serious about improving as a trader or investor, his timeless insights offer a powerful foundation.

Here are some of his most impactful principles.

Losers average losers

Adding to a losing position may seem like you’re getting a bargain, but you’re often just magnifying a bad decision [23].

Jones cautions that averaging down reflects stubborn emotional attachment, not sound analysis.

When a trade moves against you, it’s not a buying opportunity; it’s a signal to reevaluate.

Smart traders cut losses quickly, preserve capital, and wait for high-probability setups backed by fresh evidence.

Doubling down on losing positions turns manageable losses into disasters.

Stay humble and question your positions

Every trade, ask yourself: “What if I’m wrong?” Jones lives by this habit, and you should, too [24].

Markets change quickly, and ego is the enemy of progress.

When you approach your trades with humility, you’re more open to seeing new information objectively, which helps you adapt before small losses become big ones.

The goal isn’t to be right; it’s to make money, and that requires letting go of ego and staying ruthlessly honest about your trades.

Commit to lifelong learning

Paul Tudor Jones believes relentless learning is non-negotiable for long-term success.

Markets are dynamic: what worked last year may fail tomorrow.

Edges disappear, strategies get outdated, technology advances, and macro conditions shift.

To stay ahead, you must continuously study price action, economic trends, trading psychology, and risk models.

Read widely, review your trades, and learn from others’ mistakes.

In a zero-sum game, the most informed trader often wins.

Watch for market turning points

Paul Tudor Jones made his fortune by anticipating major shifts (like the 1987 Black Monday crash) before the crowd caught on [25].

He teaches that the biggest gains often come not from riding trends but from spotting when those trends are nearing exhaustion.

Reversals offer asymmetric risk-reward setups characterized by small risks and big upsides.

Learn to recognize signs of reversal, such as divergences, volume shifts, and sentiment extremes, so you can position yourself in a position to ride the next wave before others even catch on.

While the masses chase momentum, elite traders prepare for the pivot.

Measure success by returns, not size

Don’t get caught up in the numbers game.

It doesn’t matter whether you’re managing $10,000 or $10 million; what matters is how efficiently you grow it.

Jones reminds you that percentage returns reflect skill far more than dollar amounts. A 20% return on $10,000 reflects more skill than a 2% gain on $10 million if achieved with discipline and strategy.

It’s easy to feel small when others brag about seven-figure trades, but chasing size can lead to ego-driven mistakes. Focusing on returns, however, sharpens your edge.

Great traders build scalable systems that perform at any level.

Master risk, refine your process, and the capital will come.

The Bottom Line

The stock market may evolve, but human behavior and the principles that guide successful investing remain remarkably consistent.

From Warren Buffett’s disciplined value investing to Peter Lynch’s practical curiosity, from Jesse Livermore’s mastery of trading psychology to Michael Burry’s contrarian foresight and Paul Tudor Jones’s risk-first approach, each legend offers insights that are as relevant today as they were in their prime.

The takeaway?

There’s no one-size-fits-all strategy, but there are foundational truths.

Protect your capital. Think independently. Study relentlessly. Stay humble. And above all, align your approach with your temperament and circle of competence.

As you navigate the ever-changing financial landscape, let this collection of timeless wisdom serve as your compass.

Whether you’re investing for the long haul or trading short-term swings, the lessons from these masters can sharpen your edge, ground your decisions, and help you build lasting wealth.

Ready to take your investing to the next level?

Start by applying just one principle from these greats today.

Over time, the results will speak for themselves.

About the Author

Abolade Akinfenwa is a multi-certified finance professional. He’s certified as a Financial Modeling & Valuation Analyst (FMVA)®, Capital Markets & Securities Analyst (CMSA)®, Commercial Banking & Credit Analyst (CBCA)®, Financial Planning & Wealth Management Professional (FPWM)™, and FinTech Industry Professional (FTIP)™. With over five years of experience as a content marketer, Abolade specializes in helping finance professionals build authority and generate qualified leads for their services. Interested in collaborating or seeking insights? Connect with Abolade via LinkedIn, X, or email.

Sources

At ACDS Publishing, we hold ourselves to the highest standard of accuracy and credibility, ensuring that our readers receive only the most verifiable and substantiated information. To achieve this, we rely on a rigorous approach that involves sourcing information from reliable primary sources, including white papers, government data, original reporting, and expert interviews. By employing these methods, we strive to deliver factual and authoritative content that our readers can confidently trust.

- How Warren Buffett Made Berkshire Hathaway a Winner

- Warren Buffett shared timeless investment wisdom in his first-ever national TV interview nearly 40 years ago. Here are the best 9 quotes.

- 5 Pieces of Investment Advice From Famous Investors

- Why Warren Buffett invested in Coca-Cola and its lesson

- Why Warren Buffett Loves Compound Interest: The ‘8th Wonder of the World’?

- The 15 Best Things Warren Buffett Has Ever Said About Investing

- This Is How Warren Buffett’s Estate Will Invest 90% of His Non-Donated Portfolio

- Warren Buffett Has Led for Decades By This Single Enduring Principle

- Peter Lynch’s Timeless Stock Advice

- 5 Timeless Investing Rules From the Legend Who Beat the Market

- 9 Peter Lynch Lessons That Could Help You Retire Rich

- 9 Peter Lynch Lessons That Could Help You Retire Rich

- Markets Are Never Wrong; Opinions Are

- Jesse Livermore’s 21 Trading Rules

- Jesse Livermore’s Trading Strategy Explained

- Summary of Jesse Livermore’s How to Trade in Stocks

- Jesse Livermore’s Trading Rules

- Michael Burry – Best Quotes

- Michal Burry and GameStop: Missed Opportunities

- Michael Burry: The Big Short Visionary Who Saw the Crisis Coming

- Think and Invest Like Michael Burry

- Michael Burry: Market Moves and Tactics

- Paul Tudor Jones: Losers Average Losers

- Think and Trade Like Paul Tudor Jones

- Paul Tudor Jones: Here’s why the 1987 crash was an accident waiting to happen

Get newsletter updates from Alex

No spam. Just the highest quality ideas that will teach you how to build wealth via the stock market.