Memo #3: Inflation and mortgage rates continue to rise

October 14, 2022

Why does it seem like every time you turn around, the cost of living goes up? It’s not just your imagination–inflation is real and only getting worse. According to recent reports, inflation and mortgage rates are both on the rise.

What does that mean for those of us who are trying to keep up with the Joneses? Well, it looks like we’ll have to keep working harder and spending more just to keep our heads above water. And that’s not even taking into account the rising cost of education and healthcare.

But on the bright side, the stock market has been doing well in October, validating claims that the month is a “bear-market killer” (more on that later).

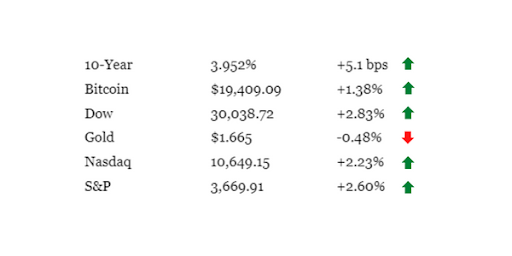

Key Market Data

3 Market-Impacting Discoveries

- Yesterday’s CPI report showed that inflation continued its upward march last month. The higher-than-expected 0.6% increase erased hopes that inflation was slowing down. It also revealed that the Fed’s multiple rate hikes have yet to ease inflation pressures and that even when the rate hikes do kick in, it will be a long slog back to normal inflation levels. The kicker is that the Federal Reserve will likely keep raising interest rates aggressively until inflation drops significantly.

- Mortgage rates hit a 20-year high after rising from 6.66% to 6.92% this week. The last time the 30-year fixed-rate mortgage was this high was in April 2002, and just a year ago, the 30-year fixed-rate mortgage stood at 3.05%. Home sales are dropping, and prices are cooling in response to the upward trend in mortgage rates.

- Fed officials expect higher rates to stay in place. They reiterated rate hikes are likely to continue, and higher rates will prevail until there is compelling evidence that inflation is on course to return to the 2 percent objective.

Interesting Developments in the Market

The good

- It would seem October is living up to its reputation as a “bear-market killer,” a phrase which describes it as a crazy month in which bear markets bottom. This reputation came from the fact that stocks have bottomed in October six times out of the past 17 bear–or near-bear markets.

The bad

- BMO Capital Markets cuts 2022 year-end S&P 500 (.SPX) outlook, saying it underestimated inflation. This came after Goldman Sachs cut its 2022 year-end target for the benchmark S&P 500 index by about 16% to 3,600 points because the Federal Reserve shows little signs of stepping back from its aggressive rate-hike stance.

To Do

Watch: This interesting video by Tom Hougaard will change the way you approach stocks and indices trading.

Read: 5 investment options to help you generate retirement income.

Listen: Check out the unconventional investing wisdom shared by Dan Irvine in this podcast: The Investing Secret To Maximizing Your Wealth.

Get newsletter updates from Alex

No spam. Just the highest quality ideas that will teach you how to build wealth via the stock market.