Memo #1: U.S. Stocks end their losing streak amid a bear market

September 30, 2022

Did you know that the Tampa Bay Buccaneers have the longest losing streak since the 1970 AFL–NFL merger? The team lost its first 26 games between 1976 and 1977. Their fans must have heaved a sigh of relief when the team ended their losing streak. Investors are pretty much heaving a sigh of relief after U.S. equities ended a six-day losing streak (more on that later).

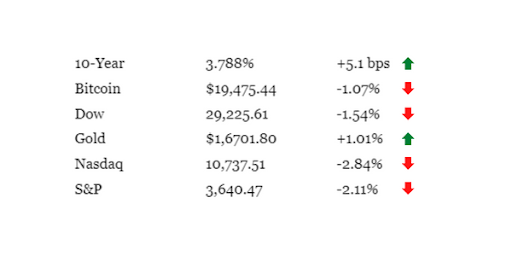

Key Market Data

3 Market-Impacting Discoveries

- After moving above 4% for the first time since 2008 on the 28th of October, 2022, bond yields (10-year note) are testing the 4% level again. Rising yields significantly impact borrowers, savers, businesses, investors, and consumers. Read about what this means for you: https://bit.ly/3SURa5O.

- This data from Bloomberg shows that buying a home is more expensive than it has been since 2021. With mortgage rates at 3% in early 2021, if you wanted to spend $2,500 on a home, you could buy a house that costs about 758k. But with mortgage rates more than double what it was in 2021, that same monthly payment would get you a house that costs $476k. That means we are talking about not just higher prices but also much lower affordability levels.

- The Bank of England’s decision to step in and calm investor fears about its teetering markets is just what the doctor ordered for the weak performance of bonds. That announcement also helped end the six-day losing streak of the Dow and the S&P 500. And the US 10-year Treasury yield posted its largest one-day drop since 2009 after the announcement!

Interesting Developments in the Market

The good

- Arguably the world’s most iconic car, Porsche made its stock market debut two days ago. At 82 euros per share (around $73 billion), Porsche’s listing on the stock market makes it the second-largest IPO in German history. The luxury vehicle has been around since 1931 when Arnold Foachieveur made his first vehicle at their Munich factory for members of the Hitler Youth movement who wanted something faster than motorcycles but not as noisy or dangerous enough so they could drive around town without getting noticed by enemies lurking nearby.

The bad

- We’re in a bear market, folks. All major U.S. stock indices: the S&P 500, Dow Jones Industrial Average, and Nasdaq, are now in a bear market, defined as at least a 20% drop from their peaks. In fact, the S&P 500 closed at a new 2022 low.

To Do

Watch: Check out this inspiring speech from Warren Buffett as he shares two stories about women who started from nothing and sold their businesses to him.

Read: Inflation is a stealth threat to your savings and investment returns. Your savings’ and investments’ rate of return has to outpace inflation by a significant percentage to get any return at all. Read about which equity sectors can help you combat high inflation.

Listen: Check out this interesting podcast on how Warren Buffett became the greatest investor ever. It’s packed with interesting insights.

Get newsletter updates from Alex

No spam. Just the highest quality ideas that will teach you how to build wealth via the stock market.